🎧 Real entrepreneurs. Real stories.

Subscribe to The Hurdle podcast today!

11 Common Business Plan Mistakes You Should Avoid

6 min. read

Updated February 9, 2024

During a business crisis, change comes at you fast. Meaning that good business planning is crucial to the survival and success of your business. However, even when you’re not navigating through a crisis, it’s easy to make mistakes that can prove to be costly for your business.

- What are the most common mistakes when writing a business plan?

Some common mistakes are classics. Others are reflections of the growing need for planning as steering and management tools. But they are all common pitfalls to avoid. Do your planning right and it’s a powerful tool for quick decisions, rapid adjustment, and optimizing management.

So, what are the most common mistakes when writing a business plan ?

1. Not planning

Too many businesses make business plans only when they have no choice in the matter. Unless a bank or investors want a plan, there is no plan.

Don’t wait to write your plan until you think you’ll have enough time. “I can’t plan. I’m too busy getting things done,” business people say. The busier you are, the more you need to plan. If you are always putting out fires, you should build firebreaks or a sprinkler system. You can lose the whole forest for paying too much attention to the individual burning trees.

You can actually put together a Lean Plan in less than 30 minutes . Here’s a free downloadable Lean Plan Template to help.

2. Using a single static plan

Now more than ever, as we deal with the crisis of 2020 and 2021, stop thinking of the business plan as just a plan. That conceptual mistake blocks you from the enormous benefits of planning as a process, with regular review and revision .

Things change overnight. Assumptions disappear into the wind. Your business planning is where you keep track of all of the connections between tasks, spending, goals, changing assumptions, and changing markets.

A good business plan is never finished. When your plan is done, your company is done. Do a lean plan and keep it fresh.

3. Losing focus on cash

Most people think in terms of profits instead of cash . When you imagine a new business, you think of what it would cost to make the product, what you could sell it for, and what the profits per unit might be.

We are trained to think of business as sales minus costs and expenses, which equals profits. Unfortunately, we don’t spend the profits in a business. We spend cash.

Understanding cash flow is critical. If you have only one table in your business plan, make it the cash flow table. Here’s a free cash flow template to help you get started.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

4. Skipping idea validation

Don’t overestimate the importance of the idea. You don’t need a great idea to start a business — you need time, money, perseverance, and common sense.

Few successful businesses are based entirely on new ideas. A new idea is harder to execute than an existing one because people don’t understand a new idea and they are often unsure if it will work.

Plans don’t sell new business ideas to investors. Plans just summarize business prospects and achievements. Investors invest in people, and their businesses, not ideas. Investors buy into a business, with milestones met and traction and validation ; not just ideas.

The plan, though necessary, is only a way to present information. So make sure you’re ready to wow your prospective investors with your knowledge and leadership skills. Don’t expect your business idea — or the business plan you explain it in — to do the work for you.

Here’s our idea validation checklist — it can help you think through whether your idea is viable before you spend a lot of time and money on it.

5. Making the planning process overwhelming

Doing a business plan isn’t as hard as you might think. You don’t have to write a doctoral thesis or a novel. As we said earlier, the simplest Lean Plan is just a few pages of bullet-point lists, tables, and essential projections.

There are good books , many advisors among the Small Business Development Centers (SBDCs), and through the SCORE business mentoring program, business schools, and there is software available to help you (such as LivePlan ).

Don’t sweat the cosmetics. Focus on the content. What matters is what you plan, not how you write about it.

6. Spongy, vague goals

Leave out the vague and meaningless babble of business phrases (such as “being the best”) because they are simply hype.

Remember that the objective of a plan is its results, and for results, you need tracking and follow-up . You need specific dates, management responsibilities, budgets, and milestones. Then you can follow up. No matter how well thought out or brilliantly presented, it means nothing unless it produces results. This article on how milestones make your business plan real and actionable will help.

7. Assuming that one size fits all

Not every business plan needs to be the same. In fact not every plan should be the same. To find success, you need to tailor your plan to its real business purpose.

Business plans can be different things: they are sometimes just sales documents to explain a new business. They can also be flexible Lean Plans, detailed action plans, financial plans , marketing plans , and even personnel plans. They can be used to start a business , or just run a business better.

Develop the plan that best suits your business goals and don’t let the planning process get the best of you.

8. Diluted priorities

Remember, strategy equals focus . If you split your priorities you split your focus and will only have difficulties making any progress.

Starting with a priority list of three to four items is the focus. A priority list with 20 items is certainly not strategic, and rarely if ever effective. The more items on the list, the less the importance of each.

9. “Hockey stick” shaped growth projections

Sales grow slowly at first, but then shoot up boldly with huge growth rates, as soon as “something” happens. The only issue is if that’s your sole projection, you’ll soon find yourself in trouble.

It’s best to have projections that are conservative so you can defend them. When in doubt, be less optimistic. In fact, it may make sense to have multiple forecasts operating — one that acts conservatively, one that’s more optimistic, and another that reflects your actual performance.

If you’re unsure of where to start, here’s how we suggest you create your sales forecast .

10. Not paying attention

We’ve seen it again in 2020 — planning works best as a process. In order to navigate volatile environments a lean plan, regular reviews, and revisions as needed are necessary. It’s not about having the document, the business plan, that isn’t the goal. It’s about a system of planning that works like driving with a GPS.

You have the long-term strategy and goals as the desired destination. You have the major milestones and metrics as the recommended route. And you have regular progress reviews as the equivalent of real-time traffic and weather information.

Steering is a matter of frequent course corrections. Planning does that for you. If you’re not paying attention, and not adjusting to external factors, your plan is worthless.

11. Sticking to the plan

Contrary to popular belief, there is no virtue in sticking to a plan, just for the sake of sticking to a plan. There are plenty of cases where your initial plan is ill-informed, missing steps, or just ineffective.

Having a plan doesn’t mean you cut your options or reduce flexibility. Having a plan means you have a dashboard tool to show the connections and dependencies. It’s about being able to make the right changes fast. It is more flexible, not less.

Tim Berry is the founder and chairman of Palo Alto Software , a co-founder of Borland International, and a recognized expert in business planning. He has an MBA from Stanford and degrees with honors from the University of Oregon and the University of Notre Dame. Today, Tim dedicates most of his time to blogging, teaching and evangelizing for business planning.

Table of Contents

Related Articles

4 Min. Read

10 Business Plan Myths That Hurt Your Business

6 Min. Read

Do This One Thing Before You Write Your Business Plan

8 Min. Read

How to Write a Business Plan in One Day [2024 Guide]

5 Min. Read

What ‘Accurate’ Means in a Business Plan

The LivePlan Newsletter

Become a smarter, more strategic entrepreneur.

Your first monthly newsetter will be delivered soon..

Unsubscribe anytime. Privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

13 Common Business Plan Mistakes to Avoid in (2024)

Business Plan Checklist

- June 1, 2024

Do you remember the first mistake you made creating a business plan?

If you smiled a little, great. It means you’ve overcome it, and you understand that entrepreneurs make business plan mistakes all the time—and continue to learn from them.

However, there are certain mistakes no business owner should make in their plan to achieve their dreams.

So, in this article, we’ve listed 13 common business plan mistakes you can avoid to get ahead in the game. But before we dive in…

What is the biggest mistake when creating a business plan?

One of the most grave business plan mistakes is having no business plan!

With no business plan, what’s your purpose, and how will you let the world know your intentions?

You don’t necessarily need to put it down on paper. But there has to be some kind of planning. Much like a north star, planning will give you direction.

Moreover, investors or clients will want to see a plan sometime down the line. Clearly, planning and documenting the plan is inevitable.

So, create a business plan. It can be a one-page business plan or a detailed one—either way, it’ll capture the essence of your vision.

13 common business plan mistakes to avoid

Now that you know you can’t escape a business plan, let’s check out the mistakes you can escape while creating a solid business plan:

1. Poor planning

The business of business planning is no joke. You can’t have a business plan in place just for the sake of it.

It has to have value—information that shows product or service viability, company details, projections, etc.

Why? Poor business planning can imply that:

- Your great idea isn’t so great because you haven’t thought it through.

- You don’t care enough, which can be unattractive for investors and banks. (You don’t want to miss out on the money.)

- You’ll witness scope creep, where stakeholders may want to add new objectives even when the project is underway. ( Not fun, is it? )

So, spend time planning, and you’ll naturally make fewer mistakes.

2. Poor executive summary

You and your business have 7 seconds to make an excellent first impression. Since an executive summary is the first impression, you don’t want to gamble with its quality.

A poor executive summary will instantly make clients and investors disinterested in your business plan—a big mistake.

So how do you fix it?

First, make it straightforward so anyone without a business background can get a clear understanding of your business idea.

Second, ensure it’s concise. Briefly mention all the important information, including:

- Business purpose

- Company description

- Market analysis

- Business goals, competition

- Financial plan

This will keep your clients or investors interested in learning about the rest of your business plans.

Lastly, don’t be shy about your intentions.

Is your focus on securing enough money for business operations?

A bad executive summary can be worse than having any executive summary

Ensure to include your cash flow table, the money you wish to borrow, and the financial projections to back up your success claims. This way, investors know you mean business and appreciate transparency right off the bat.

3. Targeting the wrong audience

Obviously, your business doesn’t target everyone in this world. So, define your target market and potential customers. This way, you can write using the vocabulary and tone that best resonates with them.

After all, you want them to understand what your business is about.

However, that’s not enough!

When you write a business plan , you also want to show your work on how you decided on your target market and how you plan to appeal to them. This is more to impress your potential investors.

4. Not doing enough research

When you create a business plan without enough research, you’re hampering your success even before you’ve started your business.

- Imagine being unaware of your target market or closest competitors.

- Imagine having yet to think of the most obvious and effective marketing strategy.

- Imagine having an outdated sales technique.

Now, imagine potential customers or investors realizing these research gaps in your business plan.

One word: Nightmare!

It only shows you’re not prepared.

Hence, remember to carry out in-depth research so there’s nothing that can discredit your business idea.

5. Unrealistic financial projections

Another common mistake is to be unrealistic or overconfident about your earning projections.

Being unrealistic shows that you either don’t understand your business or aren’t qualified enough to make accurate projections.

The result? Banks and lenders won’t trust you or your business idea.

Moreover, unrealistic financial projects are also your one-way ticket to bankruptcy.

So the point is: Be as realistic as possible to gain inventors’ trust and launch a successful business.

6. Ignoring the competition

A good, detailed business plan never ignores competition because there can be serious consequences.

Here’s everything you can’t highlight without proper competitive analysis :

- What makes you unique?

- What strategy will help you beat your competitors?

- How will you grow your credibility?

These aspects are important for your business to avoid becoming complacent and convince investors and partners that you can survive in this saturated market.

7. Poor marketing strategies

Poor marketing strategies can hurt your own company in many ways, including:

- Reduced sales or profit

- Increased expenses

- Market your product or service to the wrong audience

- Confuse customers about your brand and business idea

- Drop in product or service prices resulting in financial loss

- Lose customers to competitors

Scary list, isn’t it?

These pitfalls are why you shouldn’t make the mistake of creating lousy marketing strategies.

8. Not highlighting your team’s unique skills

Many entrepreneurs make this mistake because they often forget the company isn’t just them but their team and what they bring to the table.

So, it’s only right to mention the experience and skills of their top team in a business plan. They should also include how their team plans to achieve the business goals and overall success.

9. Poor writing and presentation

Imagine presenting a business plan with serious ideas, ambitions, profit predictions, etc. But uh-oh . You notice the spelling of ‘projections’ is missing a ‘j,’ and the color scheme is off on one of the pages.

This is a major red flag and an embarrassing mistake that can cost potential clients!

Don’t worry, it’s fixable. Just double-check your spelling and proofread like your life depends on it.

Create visually appealing business plans with our

AI Business Plan Generator

Plans starting from $7/month

10. Incomplete or missing information

A business plan is your business’s backbone. Missing any important information is like missing a disc in the spine. You’re bound to crumble.

The solution? Check your business plan multiple times to spot such mistakes.

Let others take a look as well. A fresh perspective can spot more missing information.

11. Adding too much information

Less is more. A cliche you want to employ while writing a business plan.

Investors want a clear understanding of whether you understand your business thoroughly. They can do that with just a few crisp pointers in your business plan.

In fact, visuals speak more than words. So, incorporate charts and graphs to reduce the wordiness and get your point across.

12. Being inconsistent

Focus on the consistency of your business plan’s key elements and all sections.

You don’t want to say your company predicts x amounts of profit in the executive summary only to mention y amounts of profit in the financial projections section.

Such inconsistency will only show under-preparedness to your investors—a major red flag.

13. Unclear exit strategy

A clear exit strategy is almost like a medical cover you ought to have.

When things go south (business struggles), you can’t limit your losses without a clear exit strategy.

There’s also an upside to this strategy. If your business booms, you profit significantly by selling your company shares. Either way, you’re covered!

How a business planning tool helps you avoid mistakes

Let’s just say a business planning software like Upmetrics makes everything so much easier and faster. Here’s why it’s a powerful tool:

- It helps entrepreneurs start with a basic business plan structure so they don’t miss the most important sections in their plan.

- The AI automates your business plan creation so you don’t have to worry about inconsistencies across the different sections.

- The AI can auto-write the different business plan sections in your preferred tone and style so you sound professional.

- AI-powered financial forecasting tool helps prepare accurate and realistic projections, ensuring you don’t under/overestimate them.

- Industry-specific business plan templates ensure the inclusion of industry-relevant research and marketing strategies.

Making mistakes during the planning process is only natural. But now that you know some common mistakes, you can speed up your process without making the most common and critical ones.

But what if you could speed up your business plan creation in under 10 minutes? It’s possible with an AI business plan generator .

A modern tool like Upmetrics can simplify business planning with its intuitive user interface, AI-powered features, and step-by-step guidance.

Try Upmetrics and don’t make mistakes that others do!

Build your Business Plan Faster

with step-by-step Guidance & AI Assistance.

Frequently Asked Questions

Can business planning software help me avoid mistakes.

Yes, absolutely. Business planning software like Upmetrics offers industry-specific business plan templates, saving you countless hours and avoiding errors like missing information and inconsistencies. Upmetrics’ AI can also fine-tune your content, creating a professional and factually accurate business plan without grammatical errors.

Where can I find templates or examples of successful business plans?

The first option is Google search, where you’ll find many business plans and templates to write a successful one. The second, more effective option is to try business plan software. They typically offer numerous business plan example options and templates so that you can pick and customize them depending on your business type.

How long should my business plan be?

Typically, a good business plan is between 15-30 pages . However, depending on your purpose, product or service type, and target audience, you can have a one-page business plan or a 100-page one.

About the Author

Upmetrics Team

Upmetrics is the #1 business planning software that helps entrepreneurs and business owners create investment-ready business plans using AI. We regularly share business planning insights on our blog. Check out the Upmetrics blog for such interesting reads. Read more

Get started with Upmetrics Al

- 400+ sample business plans

- Al-powered financial planning

- Collaborative workspace

Reach Your Goals with Accurate Planning

- How it Works

- Professional Advisors

- Companies & Individuals

- Advanced Knowledge Base

- Lite Knowledge Base

- Samples & Publications

- User Support

The Most Common Business Plan Pitfalls and How to Avoid Them

Recent Posts

- Why is Market Research Crucial?

- Tips for Small Businesses to Conquer Challenges of Remote Work

- Mastering the Art of Marketing: An Introduction to Marketing Plans

- How Can SMEs Leverage Artificial Intelligence (AI) to Drive Growth?

- 6 Cost-Effective Marketing Hacks

Every company benefits from an updated business plan. While it seems necessary for start-ups, it applies to established firms, too. An efficiently written business plan keeps the whole business on track in the process of execution of the company’s strategy and reaching its business goals. Business plan mistakes can result in anything ranging from small oversights to fatal errors for your business. It is even more important for the business who are at the funds raising stage, so the information they provide is accurate and none of your ideas are misleading and are in tune with the current market. To help you avoid your business plan from being discarded, here are some of the critical business plan mistakes to be careful with:

- Long and bulky Executive Summary The readers of business plan such as investors, bank institutions and key vendors start considering your business idea from reading the executive summary. Executive summary is a highlight of the most important items of your business plan in a concise but informative way. It should succinctly describe your compelling story on how a highly skilled team will deliver products or services to precisely defined target markets based on a consistent strategy. Besides, it should state the company’s value proposition on how their products or services will change the life of its customers for the better in a profitable way. In fact, many executive summaries are boring and state some business idea whose execution remains vague. Often, it is presented as just cut and paste of some sections from the introduction and some other parts of business plan. Therefore, there are high chances of the busy investor to move on to the next proposal, if executive summary does not provide a clear, convincing, and persuasive overview of the business.

- Attaching your value proposition to dated technology or dwindling markets When formulating in your business plan the opportunity you see for a product or service, you need to question it and can’t just assume that the idea has automatic demand in the real world. A professionally written business plan will assure you are setting up your business for success. This implies that you must develop a value proposition of your product or service that will change an emerging or existing market. Those markets that are shrinking or are being replaced by new industries will make it incredibly challenging for you to get funding. For instance, what would your reaction be if someone developed waterproof ink for typewriter ribbons? You wouldn’t necessarily be amazed, because the number of people looking to buy something like that is miniscule.

- Not knowing the target audience and segments A product or service that is everything to everyone does not exist. If that were so, we would all be using the same phone. In fact, your product or service is specific and advantageous to an ideal type of customer. Without defining your target market, you cannot reason how you will handle the fierce competition. There are competitors who are providing the same product and service. Investors trust their funds to companies that have completed and gained a complete knowledge of primary and secondary market. You must define your target market and outline how you will target this audience.

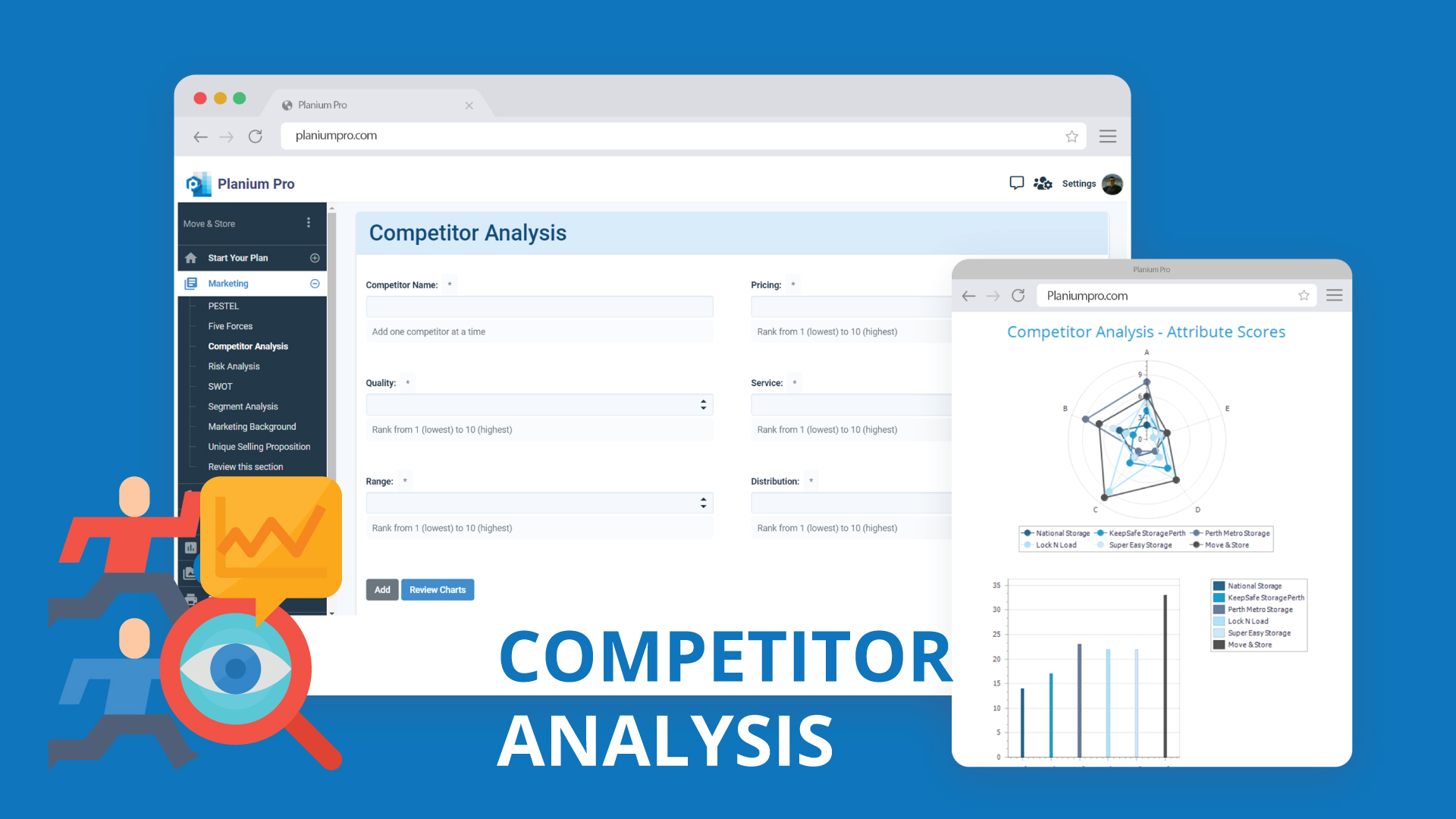

- Having unrealistic and aggressive growth projections Having read the executive summary, many investors jump straight to the financial section of the business plan. It is important that the assumptions and projections in this section to be realistic. Plans that show sales forecast, operating margin and revenues that are poorly reasoned, internally inconsistent or simply unrealistic significantly damage the credibility of the entire business plan. In opposite, sober, well-supported financial assumptions and projections communicate operational maturity and credibility. Benchmarking is an especially useful tool to use in your financial analysis. By comparing and basing your projections on the financial performance of public companies within your marketplace, you can prove that your assumptions and projections are achievable. Planium Pro makes your life easier in that regard. Finance section of the Planium Pro’s software provides an easy and quick benchmarking tool for a variety of industries so you can efficiently measure your projections and key ratios against your market averages.

- Acknowledging your competitors, but not researching them Many new businesses are too much inward-focused. Being confident about your product or service is certainly a good attitude. But there is risk that this could twist your idea of how it correlates with products and services of competitors who have been in the market for some time. Besides, quite often entrepreneurs also miss or underestimate the possibility of new entrants who could increase competitive pressure. Our recommendation is to learn as much as you can about the people you’re going up against and perform Competitor Analysis, based on their pricing, quality, service and distribution channels. Knowing this information helps you prepare your own strategy to differentiate your business from theirs.

Next Steps • Keep these critical mistakes in mind when writing your business plan. • If you have already started writing your plan, use Planium Pro software to ease your preparation and streamline the process. Join our Planium Pro to see all the benefits yourself. Read More We would be interested to receive comments from small-business owners on what mistakes you have made in business plan writing and how you fixed them.

Leave a Reply Cancel Reply

Your email address will not be published.

Save my name, email, and website in this browser for the next time I comment.

Planium Pro

For professional & advanced users

Planium Pro Lite

For startup entrepreneur or small business users

Available at the following online bookstores:

- Business Planning

11 Common Business Plan Mistakes to Avoid in 2024

Written by Vinay Kevadiya

Published Jun. 18 2024 · 7 Min Read

We all know—drafting a successful business plan is no easy feat. There are so many aspects to consider. This is especially true if you’re new to this game.

Lucky for you, there have been many entrepreneurs before you who have made many business plan mistakes so you can learn from them. In other words, they walked so you could run.

But wait, what are these mistakes? And how can you avoid such mistakes to create a good business plan?

Worry not—we're here to guide you through it all.

In this article, we've listed the 11 most common business plan mistakes that no business owner should make in their plans to get ahead of the game.

Sounds good? Let's dive right in!

11 common business plan mistakes to avoid

Even if you've got a great idea, making these common business plan mistakes can reduce your chances for funding. So, try to avoid them while creating a plan.

1. Not considering the business planning process

Some entrepreneurs don't take the business planning process seriously and draft a document just to fulfill the condition of a bank or investor.

Well, that's the biggest mistake anyone can make!

If you do so, it indicates that you really don't care about your business and haven't thought about how it will succeed. This can impact negatively.

So, try to invest your valuable time and energy into the planning process for a clear understanding of your business idea & strategies. And win potential lenders or investors.

2. Writing a poor executive summary

Since the executive summary is the first section of a plan, it provides a quick overview of your business. It's also your sole chance to engage potential investors or readers and persuade them to delve further into the plan.

If you write a poor executive summary and don't make it informative yet compelling enough, it will reduce their interest in your business plan.

Therefore, you should focus more on your plan summary and keep it simple, concise, as well as engaging.

Also, consider including all the key elements, such as business concept, market opportunities, target customers, marketing plan, and financial highlights, so that anyone can quickly understand your business idea.

3. Lack of market research

It's very crucial to conduct comprehensive market research while writing a business plan. If you skip this step, your business plan doesn't accurately reflect the market insights and facts.

Without in-depth analysis, you won't have specific knowledge of the industry, target audience, potential customers' needs & preferences, and competitors.

Also, you might miss the shifts in consumer behavior and emerging trends. This will eventually make your business plan less effective and realistic.

4. Overlooking legal & regulatory requirements

Every business has to follow necessary legal and regulatory requirements. However, overlooking these specific regulations can lead to significant issues for your business.

For instance, if you ignore securing the essential licenses and permits for your business, this can result in fines, legal actions, or even halt your business operations.

To avoid such problems, make sure that you comply with all local, state, and federal laws relevant to your business.

Note that your business plans must cover legal & regulatory compliance, contractual obligations, intellectual properties, tax obligations, and insurance requirements.

5. Underestimating your competitors

Well, it's a common mistake in many business plans—not knowing who your competitors are and/or believing that you have no competition.

But always keep in mind that every business has competition, even if your product or service is unique.

So, don't underestimate your key competitors. Identify direct and indirect competitors, including those who use other ways to solve the same problem you're addressing.

Likewise, understand their strategies and evaluate how to differentiate your business in the competitive marketplace. This will help you improve your strategy and position your business for long-term success.

6. Neglecting risk management strategies

It's a big red flag! Why?

If you don't include a robust plan for identifying and mitigating risks, this will make your business vulnerable to unexpected challenges and lead to serious setbacks or even failure.

So, it’s important to foresee potential risks that could negatively impact your business, such as market changes, financial issues, operational risks, and external threats.

Also, develop detailed risk mitigation strategies or contingency plans that help your business adapt to unforeseen changes quickly and efficiently.

This means you can protect your business and make it more trustworthy to investors.

7. Developing unrealistic financial projections

While starting a new business, most individuals often focus on profitability and develop unrealistic financial projections or overestimate the value of their business.

But, doing so will make your business plan unreliable and inaccurate. Even potential investors are much more likely to doubt your plan and reject it as they expect to see a realistic picture of your financial health.

If you don't have actual numbers, it's quite acceptable to use general assumptions and compare your estimates with industry benchmarks to set a practical baseline.

This will help you create accurate and realistic projections that make your financial plan more credible and build trust among investors.

8. Not highlighting sales and marketing strategies

If you don't summarize how you plan to attract new customers and retain existing ones, your business plan might not be effective and convincing.

Even, your plan can fall flat without clear and detailed sales & marketing strategies. This is so because potential investors or stakeholders won’t be fully persuaded of your business's potential for growth.

By having a solid yet effective marketing strategy, you can demonstrate how you will grow your business and highlight how you will influence your target market to choose your product or service over others.

9. Failing to review and update your plan

A business plan isn’t just a one-time document; it's a professional, living document that needs to be reviewed and updated regularly.

However, many entrepreneurs fail to do so, which leads to outdated strategies, missed opportunities, and poor decision-making.

So, ensure you review and update your plan as your business evolves and the market changes. This will help you stay focused on your goals and adapt to changes more effectively.

For instance, if you update your financial plan regularly, you can better manage your cash flow and make more accurate investment decisions.

10. Providing too much information

One of the most common mistakes in business plan creation is providing too much information, especially irrelevant data or excessive technical details.

We understand that it's natural to share everything about your business, but this can overwhelm and confuse potential investors or readers.

In fact, investors don't have enough time to go through all the details you mentioned but they typically look for 10 to 12 pointers in a detailed business plan.

Therefore, keep your plan concise and highlight the most essential aspects of your business that draw readers' attention. Also, use visuals and charts to convey more complex data more effectively.

11. Inconsistent information and poor presentation

Your business plan needs to be polished and well-organized as it's going to represent your business idea, goals, and strategies to achieve them.

If you state a certain sales figure in the executive summary and then mention a different amount in the financial plan, this might seem unprofessional and damage your first impression.

So, make sure that you're consistent throughout your plan and don't make any sloppy mistakes, including typos, grammatical errors, or poor formatting.

Lastly, don't forget to proofread your plan before sending it out!

Now that you're aware of these most common mistakes, you can create a business plan—either a one-page business plan or a detailed one without repeating such mistakes.

If you need help drafting a business plan that wins investors and sets a strong foundation for your business, Bizplanr could be a great choice.

It’s a modern AI business plan generator that streamlines the entire business planning process with its AI-powered features, step-by-step guides, and other valuable resources.

So, don't wait; get your first draft ready in minutes!

Get Your Business Plan Ready In Minutes

Answer a few questions, and AI will generate a detailed business plan.

Generate your Plan

Frequently Asked Questions

What should I do if my business plan is rejected by investors due to mistakes?

If your business plan is rejected by investors due to mistakes, consider following the below steps to improve the plan and increase your chances of getting funding:

- Identify the specific reasons for rejection

- Efficiently address the issues

- Strengthen your unique value proposition

- Create detailed and realistic growth plans

- Carefully proofread your plan

- Get feedback from trusted investors

- Enhance your presentation skills

How can I make sure my financial projections are realistic?

If you want to make sure your financial projections are realistic, consider using past financial performance data as a baseline, conduct thorough market analysis, use conservative estimates for revenue and expenses, plan for potential risks, provide multiple scenario analyses, as well as regularly review and update your projections.

Why do some business plans fail to impress investors?

Some business plans fail to impress investors because of skipping detailed execution strategy, unrealistic and inaccurate financial projections, lack of market research and experienced team, overlooking risk and contingency plan, or not having a clear path to profitability.

What are some common financial mistakes in business plans?

Here are a few common financial mistakes that many entrepreneurs make in their business plans:

- Unrealistic revenue projections

- Failing to account for all business expenses

- Overestimating profit margins

- Ineffective cash flow management

- Not having contingency plans

- Ignoring tax planning

As the founder and CEO of Upmetrics, Vinay Kevadiya has over 12 years of experience in business planning. He provides valuable insights to help entrepreneurs build and manage successful business plans.

Follow Vinay Kevadiya

Related Posts

7 Most Common Business Plan Myths Debunked

5 Benefits Of Using AI For Your Business Plan

The 8 AI Prompts You Need to Write a Business Plan

Like this content? Sign up to receive more!

Subscribe for tips and guidance to help you grow a better, smarter business.

We care about your privacy. See our Privacy Policy .

🎧 Real entrepreneurs. Real stories.

Subscribe to The Hurdle podcast

You can do this! Tour LivePlan to see how simple business planning can be.

Have an expert write your plan, build your forecast, and so much more.

Integrations

For Small Businesses

For Advisors & Mentors

17 Key Business Plan Mistakes to Avoid in 2024

11 min. read

Updated November 22, 2024

If you’re like most people and you’re writing a business plan for the first time, you want to make sure you get it right. Even if you follow the instructions in one of the popular business plan templates out there, you can still make mistakes.

After having spent countless hours reading thousands of business plans and having judged hundreds of business plan competitions, I’ve assembled a list of the biggest business plan mistakes that I’ve seen.

What is the biggest mistake when preparing a business plan?

The absolute biggest business plan mistake you can make is to not plan at all.

That doesn’t mean everyone must write a detailed business plan. While you should do some business planning to figure out what direction you want to take your business—your plan could be as simple as a one-page business plan, or even a pitch presentation that highlights your current strategy.

Your strategy and ideas will certainly evolve as you go, but taking a little time to figure out how your business works will pay dividends over time.

17 common business plan mistakes to avoid

Assuming you’ve at least decided that you should do some business planning, here are the top business plan mistakes to avoid:

1. Not taking the planning process seriously

Writing a business plan just to “tick the box” and have a pile of paper to hand to a loan officer at the bank is the wrong way to approach business planning.

If you don’t take the business planning process seriously, it’s going to show that you don’t really care about your business and haven’t really thought through how your business is going to be successful.

Instead, take the time and use the planning process to strengthen your understanding of how your business will be successful. It will improve your chances with lenders and investors and help you run a better business in the long run.

2. Not having a defined purpose for your business plan

Why are you writing a business plan?

Is it to raise money? Are you just trying to get your team on the same page as you so they understand your strategy? Or are you planning a new period of growth?

Knowing why you are writing a business plan will help you stay focused on what matters to help you achieve your goals, while not wasting time on areas of the plan that don’t matter for what you’re doing.

For example, if you’re writing an internal business plan, you can probably skip the sections that describe your team.

3. Not writing for the right audience

When you’re putting together your business plan, make sure to consider who your readers are. This is especially important for businesses that are in the technology and medical industries.

If your audience isn’t going to understand the specialized vocabulary that you use to describe your business and what you do, they aren’t going to be able to understand your business.

On the other hand, if your audience is going to be all industry insiders, make sure to write in the language that they understand.

4. Writing a business plan that’s too long

Don’t write a book when you’re putting together your plan. Your audience doesn’t have time to spend reading countless pages about your business. Instead, focus on getting straight to the point and make your business plan as short as possible.

Start with a one-page plan to keep things concise. You can always include additional details in an appendix or in follow-up documents if your reader needs more information.

5. Not doing enough research

You don’t need to spend endless time researching, but your business plan should demonstrate that you truly understand your industry, your target market, and your competitors. If you don’t have this core knowledge, it’s going to show that you’re not prepared to launch your business.

To keep things simple, start with this four-step process to make sure you cover your bases with an initial market analysis.

6. Not defining your target market

Don’t assume your products are for “everyone.”

Even a company like Facebook that now truly does target “everyone” started out with a focus on college students. Make sure you take some time to understand your target market and who your customers really are.

Investors will want to see that you understand who you are marketing to and that you’re building your product or service for a specific market.

7. Failing to establish a sound business model

Every business needs to eventually have a way to make money. Your business plan needs to clearly explain who your customers are, what they pay you, and have financial projections that show your path to profitability.

Without a real business model , where income covers your expenses, it will be difficult to show that you have a viable path to success.

8. Failing to showcase current traction and milestones

Great business plans are more than just a collection of ideas. They also demonstrate that you have early traction — a fancy way of saying that you have some initial success.

This could come in the form of pre-orders from a Kickstarter campaign or initial contracts that you’ve signed with your first customers. Traction can be as little as expressed interest from potential customers, but the more commitment you have, the better. The companion to traction is milestones. Milestones are simply your roadmap for the future — your next steps with details of what you’re going to do and when you’re going to do it. Make sure to include your best guess at your future timeline as part of your business plan.

9. Having unrealistic financial projections

Everyone dreams of sales that start from zero and then just skyrocket off the charts. Unfortunately, this rarely happens. So, if you have financial projections that look too good to be true, it’s worth a second look.

Investors don’t want you to be overly conservative either. You just need to have a financial forecast that’s based in reality and that you can easily explain.

Keep in mind that when first starting out, you may not have exact numbers to work with. That’s perfectly fine. You can work with general assumptions and compare against competitive benchmarks to set a baseline for your business.

The key here is to develop reasonable projections that you and any external parties can reference and see as viable.

10. Ignoring your competitors

Not knowing who your competitors are , or pretending that you have no competition, is a common mistake. It’s easy to say that you have “no competition,” but that’s just taking the easy way out. Every business has competition, even if it’s a completely different way of solving the same problem.

For example, Henry Ford’s early competition to the automobile wasn’t other cars — it was horses.

11. Missing organizational or team information

When you’re starting a business, it’s likely that you haven’t hired everyone that you’re going to need. That’s OK. The mistake people make in their business plan is not acknowledging that there are key positions yet to be filled.

A successful plan will highlight the key roles that you plan to hire for in the future and the types of people you’ll be looking for. This is especially vital when pitching to investors to showcase that you’re already thinking ahead.

12. Inconsistent information and mistakes

This almost goes without saying, but make sure to proofread your plan before you send it out. Beyond ensuring that you use proper grammar and spelling, make sure that any numbers that you mention in your plan are the same ones that you have in your financial projections.

You don’t want to write that you’re aiming for $2 million in sales, while your sales forecast shows $3 million.

13. Including incomplete financial information

You may have a great idea, but a business plan isn’t complete without a full financial forecast. Too many business plans neglect this area, probably because it seems like it’s the most challenging. But, if you use financial forecasting software like LivePlan, the process is easy.

Make sure to include forecasts for Profit and Loss, Cash Flow, and Balance Sheet. You may also want to include additional detail related to your sales forecast.

For example, if you run a subscription business, you should include information about your churn rate and customer retention.

14. Adding too much information

Don’t fall into the trap of adding everything you know about your business, your industry, and your target market into your business plan. Your business plan should just cover the highlights so that it’s short enough that people will read it.

A simple and concise plan will engage your reader and could prompt follow-up requests for additional information.

Focus on writing an engaging executive summary and push non-critical, detailed information into your appendix — or leave it out altogether and leave the details for those that ask.

Remember, your business plan is there to serve a purpose. If you’re raising money, you want to get that next meeting with your investors. If you’re sharing your strategy with your team, you want your team to actually read what you wrote.

Keep your plan short and simple to help achieve these goals.

What should not be included in a business plan?

Here are a few things to leave out of your plan:

- • Full resumes of each team member. Just hit the highlights.

- • Detailed technical explanations or schematics of how your product works. Put these in the appendix or just leave them out completely.

- • A long history of your industry. A few sentences should be enough.

- • Detailed market research. Yes, you want market research but just include the summary of your findings, not all the data.

Make sure to include:

- • Executive summary.

- • Financial projections.

- • Market research (just a summary)

- • Competition overview

- • Funding needs (if you’re raising money)

15. Having no one review your plan

As with any work that you do, it’s always helpful to have a few other people take a look at your work as you go. You don’t have to please everyone and you don’t have to implement every comment, but you should listen for themes in your feedback and make adjustments as you go.

A fresh pair of eyes will always help spot pesky typos as well as highlight areas of your plan that may not make sense. You can even explore having a plan writing expert review your plan for a more in-depth analysis.

16. Never revisiting your business plan

Business plans are never 100% accurate and things never go exactly as planned. Just like when you set out on a road trip, you have a plan to reach your final destination and an idea of how you will get there.

But, things can change as you go and you may want to adjust your route.

Planning for your business is often the same as that road trip and your plans will change as you grow your business. Keeping your plan updated will help you set new goals for you and your team and, most importantly, set financial goals and budgets that will help your business thrive.

Incorporate your plan into regular review meetings to be sure you’re consistently revisiting it and integrating the time spent reviewing into your current workflow.

17. Not using your business plan to manage your business

Revisiting and revising your business plan is how you use your plan to manage your business. If you aren’t updating your goals and following a budget, you’re flying blind. Your plan is your ultimate tool to help you manage your business to success. You can use it to set sales goals and figure out when and how you should expand.

You’ll use your plan to ensure that you have healthy cash flow and enough money in the bank to handle your growth. Without managing your plan, you’re left to guess and live with a level of uncertainty about where your business is headed.

How a business planning and management tool helps you avoid mistakes

Writing a business plan can seem like a daunting task. Sure, you can do it yourself with free templates and advice like you find on this website. But, doing it on your own can just slow the process down, lead to mistakes, and keep you from actually working on building your business.

Instead, consider using a planning tool, like LivePlan, which features step-by-step guidance and financial forecasting tools that propel you through the process.

LivePlan will help you include only what you need in your plan and reduce the time you spend on formatting and presenting. You’ll also get help building solid financial models that you can trust, without having to worry about getting everything right in a spreadsheet.

Finally, it will transform your plan into a performance management tool to help you easily compare your forecasts to your actual results. This makes it easy to track your progress and make adjustments as you go.

So, whether you’re writing a plan to explore a new business idea, looking to raise money from investors, seeking a loan, or just trying to run your business better—a solid business plan built with LivePlan will help get you there.

Like this post? Share with a friend!

Noah Parsons

Before joining Palo Alto Software , Noah Parsons was an early Internet marketing and product expert in the Silicon Valley. He joined Yahoo! in 1996 as one of its first 101 employees and become Producer of the Yahoo! Employment property as part of the Yahoo! Classifieds team before leaving to serve as Director of Production at Epinions.com. He is a graduate of Princeton University. Noah devotes most of his free time to his three young sons. In the winter you'll find him giving them lessons on the ski slopes, and in summer they're usually involved in a variety of outdoor pursuits. Noah is currently the COO at Palo Alto Software, makers of the online business plan app LivePlan.

Table of Contents

Related articles.

Elon Glucklich

November 22, 2024

Budget Vs Forecast: Differences Explained + What to Prioritize

November 23, 2024

What Is Accounts Receivable (AR)? [Definition + 6 Ways to Improve]

Cash Flow Statement: Definition + How to Create and Read it

Cash Flow Explained | What is it, Why it Matters, and How to Calculate

IMAGES

COMMENTS

Feb 9, 2024 · What are the most common mistakes when writing a business plan? Some common mistakes are classics. Others are reflections of the growing need for planning as steering and management tools. But they are all common pitfalls to avoid. Do your planning right and it’s a powerful tool for quick decisions, rapid adjustment, and optimizing management ...

Jan 31, 2024 · Wise Business Plans can help you in Business plan mistakes to avoid when writing a business plan. Also, you can download our 300+ free business plan templates covering a wide range of industries. OR, Get Started on your business plan by downloading our free sample business plans in Pdf written for different organizations to put your mind at ease.

Jun 1, 2024 · 13 common business plan mistakes to avoid. Now that you know you can’t escape a business plan, let’s check out the mistakes you can escape while creating a solid business plan: 1. Poor planning. The business of business planning is no joke. You can’t have a business plan in place just for the sake of it.

Nov 1, 2020 · Every company benefits from an updated business plan. While it seems necessary for start-ups, it applies to established firms, too. An efficiently written business plan keeps the whole business on track in the process of execution of the company’s strategy and reaching its business goals. Business plan mistakes can result in anything ranging from small […]

Jun 18, 2024 · In this article, we've listed the 11 most common business plan mistakes that no business owner should make in their plans to get ahead of the game. Sounds good? Let's dive right in! 11 common business plan mistakes to avoid. Even if you've got a great idea, making these common business plan mistakes can reduce your chances for funding.

Nov 22, 2024 · 3. Not writing for the right audience. When you’re putting together your business plan, make sure to consider who your readers are. This is especially important for businesses that are in the technology and medical industries.