Advantages and disadvantages of having a lot of money.

Unauthorized use and/or duplication of this material without express and written permission from this site’s author and/or owner is strictly prohibited. Excerpts and links may be used, provided that full and clear credit is given to Writing9 with appropriate and specific direction to the original content.

Fully explain your ideas

To get an excellent score in the IELTS Task 2 writing section, one of the easiest and most effective tips is structuring your writing in the most solid format. A great argument essay structure may be divided to four paragraphs, in which comprises of four sentences (excluding the conclusion paragraph, which comprises of three sentences).

For we to consider an essay structure a great one, it should be looking like this:

- Paragraph 1 - Introduction

- Sentence 1 - Background statement

- Sentence 2 - Detailed background statement

- Sentence 3 - Thesis

- Sentence 4 - Outline sentence

- Paragraph 2 - First supporting paragraph

- Sentence 1 - Topic sentence

- Sentence 2 - Example

- Sentence 3 - Discussion

- Sentence 4 - Conclusion

- Paragraph 3 - Second supporting paragraph

- Paragraph 4 - Conclusion

- Sentence 1 - Summary

- Sentence 2 - Restatement of thesis

- Sentence 3 - Prediction or recommendation

Our recommended essay structure above comprises of fifteen (15) sentences, which will make your essay approximately 250 to 275 words.

Discover more tips in The Ultimate Guide to Get a Target Band Score of 7+ » — a book that's free for 🚀 Premium users.

- Check your IELTS essay »

- Find essays with the same topic

- View collections of IELTS Writing Samples

- Show IELTS Writing Task 2 Topics

You recently stayed at a hotel conference with your company and there were several problems with your room. Write to the hotel management to complain. Include • Where you stayed • What the problems were • How they can fix your complaint.

One of your friends recently had a birthday celebration, but you missed it and you forgot to tell your friend that you couldn't attend. write a letter to your friend. in your letter: - apologise for missing the birthday celebration; - explain why you missed it and why you didn't tell your friend; - and say what you would like to do to show that you are sorry., government needs to spend money to encourage the development of sport and art for school students, rather than to support professional sports and art events. do you agree or disagree, some people say that advertising is extremely successful at persuating us to buy things. other people think that advertising is so common that we no longer pay attention to it. discuss both views and give your own opinion., computers and ai technology are increasingly being used for online education. can artificial intelligence enhance the learning experience is this a positive or negative development.

IELTS Mentor "IELTS Preparation & Sample Answer"

- Skip to content

- Jump to main navigation and login

Nav view search

- IELTS Sample

IELTS Writing Task 2/ Essay Topics with sample answer.

Ielts essay # 1351 - money makes life easier and more comfortable, ielts writing task 2/ ielts essay:, some people believe that money makes life easier and more comfortable. others think that a large amount of wealth brings more trouble., do the advantages of having a lot of money outweigh the disadvantages.

- IELTS Essay

- Writing Task 2

- Advantages and Disadvantages Essay

- IELTS Essay Sample

- Do advantages outweigh disadvantages

IELTS Materials

- IELTS Bar Graph

- IELTS Line Graph

- IELTS Table Chart

- IELTS Flow Chart

- IELTS Pie Chart

- IELTS Letter Writing

- Academic Reading

Useful Links

- IELTS Secrets

- Band Score Calculator

- Exam Specific Tips

- Useful Websites

- IELTS Preparation Tips

- Academic Reading Tips

- Academic Writing Tips

- GT Writing Tips

- Listening Tips

- Speaking Tips

- IELTS Grammar Review

- IELTS Vocabulary

- IELTS Cue Cards

- IELTS Life Skills

- Letter Types

- Privacy Policy

- Cookie Policy

- Copyright Notice

- HTML Sitemap

What are the Advantages and Disadvantages of Money? – Answered!

Read this article to learn about Advantages and Disadvantages of Money!

Advantages of Money:

Paper money has got several advantages and disadvantages.

The following advantages can be mentioned:

(i) Economical:

ADVERTISEMENTS:

Paper money practically costs nothing to the Government. Currency notes, therefore, are the cheapest media of exchange. If a country uses paper money, it need not spend anything on the purchase of gold or minting coins. The loss which a country suffers from the wear and tear of metallic money is also avoided.

(ii) Convenient:

Paper money is the most convenient form of money. A large amount can be carried conveniently in the pocket without anybody knowing it. It is very risky to carry on one’s person Rs. 5,000 in cash, but not in notes. It possesses, in a very large measure, the quality of portability which a money material should have. In a very small bulk, it can contain a very large value. Think of a currency note of Rs. 10,000.

(iii) Homogeneous:

One essential quality in money is that it must be exactly of the same type. Even among the coins there are good and bad coins. But currency notes are all exactly similar. It is, therefore, a very suitable medium of exchange.

(iv) Stability:

The value of paper money can be kept stable by properly regulating its issue. That is why there are many advocates of ‘managed’ paper currency.

(v) Elasticity:

Paper money is absolutely elastic. Its quantity can be increased or decreased at the will of the currency authority. Thus paper money can better meet the requirements of trade and industry.

(vi) Cheap Remittance:

Money in the form of currency notes can be cheaply remitted from one place to another in an insured cover.

(vii) Advantageous to Banks:

Paper money is of very great advantage to the banks. They can keep their cash reserves against liabilities in this form, for currency notes are full legal tender.

(viii) Fiscal advantages to the Government of the paper currency are undoubtedly very great, especially in times of national emergencies like a war. A modern war cannot be prosecuted by taxes or loans alone. All governments have to resort to the printing press. In recent years in India there has been great inflation. We must remember that by this means our Government has been able to spend hundreds of crores of rupees on various ambitious programmes of development. Hence within limits the issue of paper money comes very handy to the government at the time of dire need.

Disadvantages of Paper Money:

But we cannot overlook the disadvantages of money:

(i) Paper money is of no value outside the country of issue. Gold and silver coins are accepted even by foreigners, as they have got some intrinsic value.

(ii) There is a possibility of the damage to paper. Fire may burn it; if the place is flooded, it is gone; it may also be eaten up by white ants.

(iii) A serious drawback in paper currency is the ease with which it can be issued. There is always a danger of its over-issue when the Government is in financial difficulties. The temptation is too great to be resisted. Once this course is adopted, however, it gathers momentum and leads to further note-printing, and this goes on till the paper currency loses all value. This happened in various countries in recent times: in Russia (1917), in Germany (1919), in China (1944), and so on.

An over-issue of notes, in other words ‘inflation’, brings many evils in its train.

Some of them are:

(a) Prices rise steeply. As a result, labourers and people with fixed incomes suffer greatly. The whole public feels the pinch.

(b) The indirect result of the excessive rise in prices is a fall in exports and a rise in imports. This leads to the export of gold from the country, which is not a desirable thing. Its balance of payments becomes unfavorable.

(c) The rise in prices also leads to a fall in the external value of the home currency. The rate of exchange falls. More home money will have to be paid to buy units of foreign currencies.

Conclusion:

Really, paper money, if it is issued and regulated carefully, is without any disadvantage. All countries issue paper currency, and, in normal times, they do not suffer from it in any manner. Only when it is over-issued, it becomes a great danger and a curse. It may cause grave discontent among the masses. When paper money is over-issued, there is inflation and prices rise. It hits hard several important sections of the people like workers and fixed- encomiasts.

The people might lose confidence in the currency and it might become useless. Such a situation arose in many European countries during and after World War I, and later more recently in China. It is remarkable that Indian Government was able to control inflation, whereas even countries like the U.K. were unable to check it.

Related Articles:

- 3 Standards of Monetary Systems

- Advantages of Money: 8 Important Advantages of Money– Explained!

- Floating Exchange Rates: Advantages and Disadvantages | Currencies

- Money Supply – Meaning and Measures of Money Supply

Advantages and Disadvantages of Money

Looking for advantages and disadvantages of Money?

We have collected some solid points that will help you understand the pros and cons of Money in detail.

But first, let’s understand the topic:

What is Money?

Money is a medium of exchange that is widely accepted in transactions for goods and services. It can take the form of physical currency or electronic currency.

What are the advantages and disadvantages of Money

The following are the advantages and disadvantages of Money:

Advantages of Money

- Facilitates trade and commerce – One of the primary advantages of money is that it enables us to buy and sell goods and services. Before money, people used to barter, which meant trading goods or services directly with each other. This process was often difficult and time-consuming. However, with money, people can exchange it for any goods or services they need quickly and easily.

- Provides a measure of value – Money serves as a standard measure of value that can be used to compare the worth of different goods and services. For example, we can compare the value of a house to a car using money as the common denominator. This standardization allows us to make informed decisions about how we spend our money and allocate our resources.

- Promotes savings and investment – Money allows people to save and invest for the future. When we save money, we can use it to make purchases later on. When we invest money, we can earn more money over time. Savings and investment are important because they allow us to plan for our future, such as retirement or buying a house.

- Enables financial transactions – Money is essential for financial transactions like paying bills, loans, taxes, and salaries. Electronic transactions such as wire transfers, online banking, and mobile payments have made financial transactions more efficient and secure. With money, we can easily transfer funds between accounts or make purchases using credit or debit cards.

- Empowers individuals – Finally, money gives individuals a sense of independence and control over their lives. Having money means that we can make choices about how we spend our time and what we buy. It allows us to provide for ourselves and our families, pursue our passions and hobbies, and support causes that we care about.

Also check:

- 10 Lines on Money

- Essay on Money

- Speech on Money

Disadvantages of Money

- It can make people greedy – When people have a lot of money, they can become greedy and selfish. They may not care about others as much and prioritize their own wants and needs.

- It can lead to theft – Money is valuable and desirable, which means that some people will try to steal it. People may be robbed, and thieves may steal money from stores and banks.

- It can cause inflation – When there’s too much money in circulation, prices can rise rapidly, which is known as inflation. This can make it difficult for people who don’t have much money to afford the things they need.

- It can create debt – When people borrow money, they have to pay it back with interest, which means they end up owing more than they originally borrowed. This can lead to debt, which can be stressful and difficult to manage.

- It can create social inequality – Money can create a divide between the rich and the poor. People who have more money may have more opportunities and privileges, while those who have less may struggle to get by.

- Advantages and disadvantages of K-Map

- Advantages and disadvantages of Map

- Advantages and disadvantages of Government Job

You can view other “advantages and disadvantages of…” posts by clicking here .

If you have a related query, feel free to let us know in the comments below.

Also, kindly share the information with your friends who you think might be interested in reading it.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

12 Advantages and Disadvantages of Money

Money serves as a fundamental medium of exchange in modern economies, offering several advantages and disadvantages in various financial transactions and scenarios.

- Redaction Team

- February 19, 2024

- Business Planning , Entrepreneurship

Advantages of Money

- Medium of Exchange : Money facilitates the exchange of goods and services, streamlining transactions and eliminating the need for barter systems.

- Payment Convenience : With cash, credit cards, and debit cards, money provides convenient methods for making purchases both in-person and online.

- Access to Goods and Services : Money grants individuals access to a wide range of goods and services, enabling them to fulfill their needs and desires through purchases.

- Investment Opportunities : Money allows individuals to invest in various assets such as stocks, bonds, real estate, and businesses, potentially generating returns and building wealth over time.

- Emergency Preparedness : Having savings in the form of money provides a financial safety net during emergencies or unexpected expenses, offering security and peace of mind.

- Portability and Security : Money in the form of cash or digital currency is portable and can be securely stored in bank accounts or digital wallets, reducing the risk of loss or theft compared to physical assets.

Disadvantages of Money

- Risk of Overspending : Easy access to money, particularly through credit cards and loans, can lead to overspending and accumulating debt if not managed responsibly.

- Interest and Fees : Borrowing money through credit cards or loans often incurs interest and fees, increasing the overall cost of purchases and reducing savings potential.

- Inflation : Holding onto cash for extended periods may result in loss of purchasing power due to inflation, diminishing the value of savings over time.

- Security Risks : While digital forms of money offer convenience, they also pose security risks such as identity theft, hacking, and fraud, necessitating robust security measures to protect financial assets.

- Limited Access : In some regions or circumstances, individuals may face limited access to banking services and financial resources, hindering their ability to participate fully in economic activities.

- Dependency on Financial Institutions : Relying on banks and other financial institutions for managing money entails dependence on their stability and reliability, exposing individuals to systemic risks in the event of economic crises or banking failures.

Conclusion of Advantages and Disadvantages of Money

In conclusion, when considering the pros and cons of various payment methods and investment vehicles such as money market accounts, savings accounts, and cash, it’s essential to weigh the benefits and drawbacks to make informed financial decisions.

Money market accounts offer advantages such as relatively low risk, competitive interest rates, and the security of FDIC insurance for deposits. However, they may come with limitations and disadvantages, including restrictions on withdrawals and potential lower returns compared to riskier investments. Conversely, using cash provides the benefit of immediate access and the avoidance of interest charges, but it also carries risks such as loss or theft.

Additionally, credit card transactions offer convenience and security, but they come with the temptation of impulse spending and the potential for accumulating debt. Each method serves different financial needs and objectives, so it’s important to clarify your investment objectives and assess your tolerance for risk when choosing between them.

Ultimately, understanding the advantages and disadvantages of each payment method and investment vehicle can help you make informed financial decisions tailored to your individual circumstances and goals.

Privacy Overview

CBSE Library

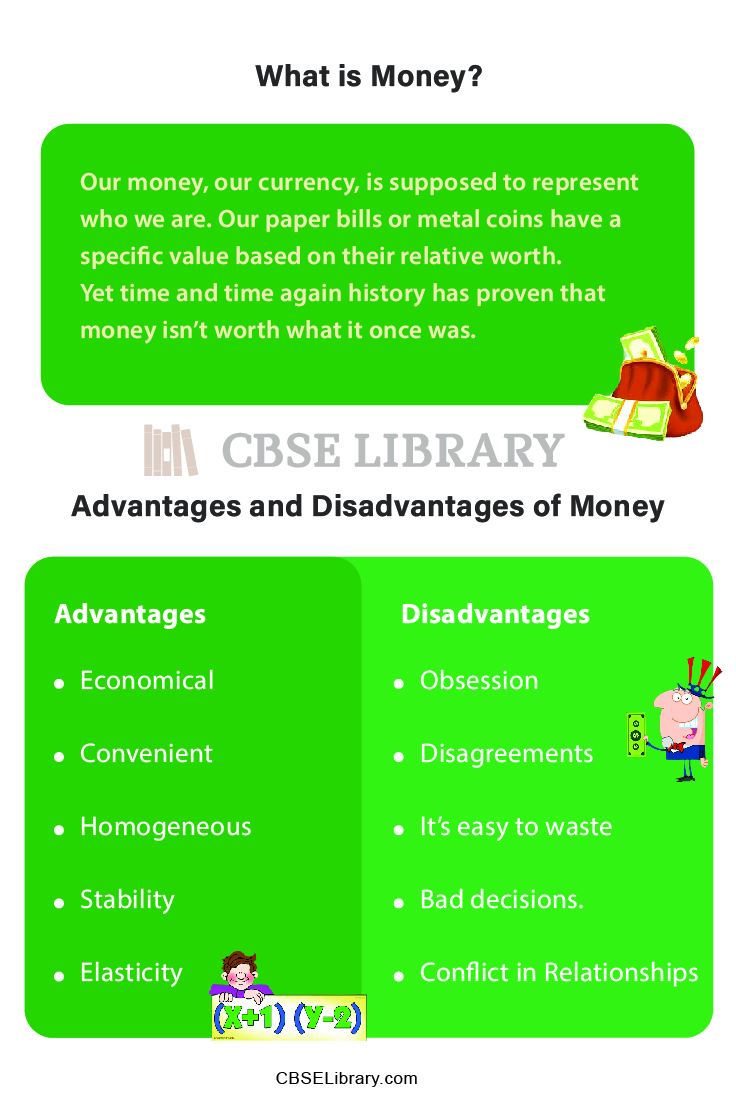

Advantages and Disadvantages of Money | What is Money?, Importance, Types, Pros and Cons

Advantages and Disadvantages of Money: Money itself has no intrinsic value, but it’s still one of the most valuable things around. Money has become so important in our society that we even have a word for the fear of being without it – monophobia – and few things will motivate people more than the fear of poverty or deprivation. And that raises some interesting questions about money itself, including whether or not you can actually have too much of it and if it really does buy happiness after all. So, what are the advantages and disadvantages of money? Let’s take a look at some of these issues below.

Students can also find more Advantages and Disadvantages articles on events, persons, sports, technology, and many more.

Advantages of Money

Disadvantages of money, comparison table for advantages and disadvantages of money, faq’s on advantages and disadvantages of money, why is it so hard to save money.

Our money, our currency, is supposed to represent who we are. Our paper bills or metal coins have a specific value based on their relative worth. Yet time and time again history has proven that money isn’t worth what it once was. The history of money is particularly interesting because its origins have long been thought to be derived from gold or silver. However, over time we find that paper bills become commonly used in trade as opposed to actual precious metals such as gold or silver.

- The role of money in our lives is crucial.

- We need it to buy things that we can’t produce ourselves, whether it be a physical or intellectual good.

- It is used as a form of currency in trade for goods or services. Unfortunately, money isn’t always easy to get.

- The most common way of getting money is through employment where you work for someone else and they pay you with their money.

There are a lot of advantages to having money. When you have more money than you need, life becomes easier. You can afford to pay someone else to do your chores for you. Having enough cash makes it possible for you to take a vacation from time to time without having to save up all year first.

Economical: Having money makes it easier to buy things. For example, if you need a new car, but don’t have enough cash on hand to pay for it, you’ll have to save up for months or years before you can afford one. If you do have enough money in your bank account, however, you can simply go out and buy a car right away.

Convenient: When you have enough money, you can pay someone else to do your chores for you. For example, if you don’t have time to mow your lawn or shovel your snow, you can hire a teenager down the street to do it for a small fee.

Homogeneous: When you have enough money, you can take a vacation from time to time. If you don’t have any money saved up, however, you’ll have to save up for months or years before you can afford a trip. In other words, having money makes it possible for you to escape your daily routine every once in a while.

Stability: Having money makes it possible for you to weather financial storms. For example, if you lose your job, having a lot of cash in your bank account will help you pay your bills until you find another job. If you don’t have any money saved up, however, losing your job could put you in dire straits financially.

Elasticity: If you have enough money, you can use it to pay off your debts. For example, if you owe $20,000 on your credit card, having a lot of cash in your bank account will help you pay that debt off faster. If you don’t have any money saved up, however, paying off that debt will take years.

The biggest disadvantage to money is its ability to distract you from what matters. Having a steady income can quickly become addicting, making you less likely to step back and evaluate your life as a whole.

Obsession: A lot of people are obsessed with money. They constantly talk about it, read about it, think about it, and make decisions based on how they can earn more. This obsession can be a problem because you might start to measure your self-worth by how much money you have in your bank account.

Disagreements: Another problem with money is that it can cause disagreements between friends, family members, or business partners. For example, if you’re in a partnership with someone who makes significantly more than you do, there’s a good chance they’ll start to feel like they deserve more say in how your company is run.

It’s easy to waste: Money is easy to waste. All you have to do is buy something you don’t need or make a decision that doesn’t align with your values. It’s a lot harder to waste time because time only moves forward—you can’t get it back once it’s gone. But money can disappear in an instant if you spend it on things that aren’t important to you.

It can cause you to make bad decisions: Having a lot of money can also cause you to make bad decisions. For example, if you’re desperate for cash, you might take on a job that’s unethical or immoral—even if it pays well. Or maybe you have too much money in your bank account and decide to spend it on something frivolous instead of saving it for an emergency.

It can cause conflict in your relationships: The final disadvantage to money is that it can cause conflict in your relationships. For example, if you’re married or in a relationship with someone who makes significantly more than you do, there’s a good chance that person will want to make all of the decisions about how your money is spent.

Question 1. What are the 4 types of money?

Answer: In economics, money is anything that is generally accepted as payment for goods and services and repayment of debts in a given country or socio-economic context. Four Types of Money are:

- Commodity money

- Representative money

- Digital currency.

Question 2. Why is it called money?

Answer: Money is simply called money as a sort of common man’s language for identifying all forms. Money has also been used to refer to any form of currency, including specie, but it is now often understood to refer only to fiat currency. However, many things can be used as money that is not legal tender: checks, credit cards, raffle tickets, IOUs, etc.

Question 3. What is fiat money?

Answer: Fiat money is a currency without intrinsic value established as money by government regulation or law. The term derives from the Latin fiat (meaning let it be done). The dollar, for instance, has no intrinsic value, but has legal tender status in all US territories and federal districts; however, its value is still maintained partly by convention (i.e., agreement within society) that it must be accepted as payment for debts.

Question 4. Why is money so important?

Answer: Money is so important because it helps us to do transactions in a very easy way. For example, if you want to buy something, you just need to pay money and get what you want. If you want to rent a house or apartment, you need to pay money as a deposit for that apartment or house so that owner will give it to you for rent.

Conclusion on Advantages and Disadvantages of Money

Leave a comment cancel reply.

Sample details

- Words: 2338

- Views: 1,542

Related Topics

- Variable Cost

- Board of directors

- Entrepreneur

- Market economy

- Free Market

- Stakeholder

- Macroeconomics

- Economic Inequality

- Luxury goods

- Interest rate

Advantages and Disadvantages of Spending Money

Everyone uses money. We all want it, work for it and think about it. If you don’t know what money is, you are not like most humans. However, the task of defining what money is where it comes from and what its worth belongs to those who dedicate themselves to the discipline of economics. While the creation and growth of money seems somewhat intangible, money is the way we get the things we need and want. Here we look at the multifaceted characteristics of money. Before the development of a medium of exchange, people would barter to obtain the goods and services they needed.

This is basically how it worked: two individuals each possessing a commodity the other wanted or needed would enter into an agreement to trade their goods. This early form of barter, however, does not provide the transferability and divisibility that makes trading efficient. For instance, if you have cows but need bananas, you must find someone who not only has bananas but also the desire for meat. What if you find someone who has the need for meat but no bananas and can only offer you bunnies? To get your meat, he or she must find someone who has bananas and wants bunnies.

ready to help you now

Without paying upfront

The lack of transferability of bartering for goods, as you can see, is tiring, confusing and inefficient. But that is not where the problems end: even if you find someone with whom to trade meat for bananas, you may not think a bunch of them is worth a whole cow. You would then have to devise a way to divide your cow (a messy business) and determine how many bananas you are willing to take for certain parts of your cow. To solve these problems came commodity money, which is a kind of currency based on the value of an underlying commodity.

Colonialists, for example, used beaver pelts and dried corn as currency for transactions. These kinds of commodities were chosen for a number of reasons. They were widely desired and therefore valuable, but they were also durable, portable and easily stored. Another example of commodity money is the U. S. currency before 1971, which was backed by gold. Foreign governments were able to take their U. S. currency and exchange it for gold with the U. S. Federal Reserve. If we think about this relationship between money and gold, we can gain some insight into how money gains its alue: like the beaver pelts and dried corn, gold is valuable purely because people want it. It is not necessarily useful – after all, you can’t eat it, and it won’t keep you warm at night, but the majority of people think it is beautiful, and they know others think it is beautiful. Gold is something you can safely believe is valuable. Before 1971, gold therefore served as a physical token of what is valuable based on people’s perception. Money is any object or record, that is generally accepted as payment for goods and services and repayment of debts in a given country or socio-economic context.

The main functions of money are distinguished as: a medium of exchange; a unit of account; a store of value; and, occasionally, a standard of deferred payment. Any kind of object or secure verifiable record that fulfills these functions can serve as money. Money originated as commodity money, but nearly all contemporary money systems are based on fiat money. Fiat money is without intrinsic use value as a physical commodity, and derives its value by being declared by a government to be legal tender; that is, it must be accepted as a form of payment within the boundaries of the country, for “all debts, public and private”.

Everybody knows the value of money. Nothing is more powerful than money. In fact, if we have no money, we cannot buy goods, clothes and other necessaries we need. Without money, we cannot go to the movies, theaters or other amusements places. How can we spend our free time pleasantly on rainy evenings without a color television in front of us? Music from a new hi-fi can relax us quickly after a hard day of work. But how can we satisfy our needs, our desires and our pleasures when we cannot afford to buy them? Thanks to money we can improve our spiritual activities easily.

We can go to any schools; any universities we like to further our knowledge. If our parents are wealthy and powerful we may be sent abroad to study. Moreover, we can enjoy pure happiness by contributing our money to Charity funds to help the poor, the wretched and the victims of other disasters. But money not only brings us the good but the bad as well. This accounts for much of the wickedness in the world. The rich often depend on it to oppress the poor and millionaires sometimes treat their servants with great cruelty.

Many young people, being purse proud of their parent’s wealth and richness, neglect their school activities, always play truant and indulge themselves in alcohol, gambling and debaucheries. They often commit suicide after playing ducks and drakes with all their parents’ fortune. Money, in this way, is the root of all evils. To sum up, happiness does not depend on the quantity of money but on the way how we use it. We should use our money properly. The right use of money may bring us a comfortable life and a cheerful heart. What were you taught about money as you were growing up?

Something like “money doesn’t grow on trees”, or “money is the root of all evil”, or maybe “all rich people are greedy”? Well, how do you expect to become a success financially if you believe these things? You attract into your life what are thinking about and what you believe. If you think there is not enough money in this world for everyone you will never have enough money. That is called the Law of Attraction. First of all, believing that “money doesn’t grow on trees” is an example of what’s called lack or scarcity programming.

Our parents taught us that there was never enough money to go around, and that it was not readily available or abundant. But in truth, the universe is very abundant, and there is lots of money to go around for everyone. Just think what you could do if you have so much money how much your heart desires. What wonderful things you could do with it: travel to the countries you have always dreamt of, buy a house you even scared to think about it, attend meditation classes so you could spiritually grow, donate money to your favorite charity, spend more quality time with your family and the list goes on.

The key is to start thinking that you deserve the money and that there is lots of it available for you, and then you can start attracting it into your life. That’s abundance thinking, which is the opposite of lack or scarcity thinking. When you start thinking about the abundance the Law of Attraction will do the rest. You do not need to know how it is going to happen just make the first step, first thought. Starting is already winning. And what about thinking that “money is the root of all evil”? Can you really expect to become a success if you believe that money is the root of all evil?

Unless you have a desire to be an evil person, your subconscious will not let you have money if you believe deep down that it is the root of all evil. By the way, that quote is taken out of context in the first place. It was originally stated as “the love of money is the root of all evil”. So it has nothing to do with the money itself. Now that you understand that, you can start to think that money is in fact good. You can help people with money. You can stimulate the economy with money. Even the most kind-hearted spiritual person, who says they don’t eed money, can do more to make the world a better place with money than without it. And what about thinking that “all rich people are greedy”? Well, that creates us versus them, whereby you have labeled all of “them” greedy in your mind. You, on the other hand, are very giving in your mind. That’s why you don’t have money, because you’re not greedy. Sure, there must be some rich people in the world who are greedy. But there are also poor people who are greedy. There are both rich and poor people who are very giving as well. The amount of money you have has nothing to do with these character traits.

In fact, a lot of rich people got there by not being greedy. Having a giving attitude opens up a flow of money that often brings them more. You will find the same thing… give away money joyfully to a friend, and notice that it comes back to you in some other form. The world needs to be a balance of give and take, and being joyful both as you give and receive will ensure that you always go with the flow. And changing your mindset from what you were taught as a child to a healthier view of money will allow you to become the financial success you deserve to be, to become real you.

Money does change people either positively or negatively, GENERALLY, we may classify people in two types when it comes to their reaction to sudden wealth: FIRST TYPE: positive change: This is when money changes the way you live, you’ll be indulging yourself and enjoying a better living standards, better home better car, better education and better whatever. Sometimes and I say sometimes, your interests change I mean you add new interests to your old ones. This is a desirable and an expected change. SOCOND TYPE: negative change:

As a consequence, people as their income rise and as their living standards go up, their surrounding change, they can’t still go out with their old buddies’ coz they don’t share common interests with or because they seek wealthier friends, this is a negative change. Money mustn’t change the way you look at your people, it is possible that with money you’d have new interests and new friends but you can’t replace your old buddies, never but unfortunately some people fall into this pattern. Having lots of money can be like a drug.

It can make you feel powerful and giddy (frivolous). It can convince you that everything’s going to be okay. Years ago they asked the great fighter Joe Louis what he thought about money, and he said, “I don’t like money very much, but it calms my nerves. ” Money makes us unjustifiably feel that we’re better and more important than we really are. When money can make you feel humble (umile – modesto), then I think it’s really useful. But if it fattens your ego, which it often does, then look out. That way lays madness.

That’s what all the Greek tragedies are about — hubris — and that’s part of the problem with money. It is greatness, it is power, it is beauty. Money is about love and relationships. It has a wonderful power to bring people together as well as tear them apart. You can’t escape money. If you run from it, it will chase you and catch you. A great philosopher once said “Money is a barrier against all possible evils. ” Let’s explore and expand on this thought. Money can prevent the sufferings that come with poverty like cold and hunger.

While sickness cannot be totally obliterated by money, it can be considerably relieved by it. Generating wealth and giving away money to charity can also provide us with the satisfaction of relieving others from suffering. With money, we can obtain an advanced education that may aid us in the development of genius and extraordinary achievements. It gives us the leisure to devote a part of our time to culture and art. Money can provide a powerful diversion for all or our troubles by permitting distraction from society anxieties that assail us.

So we must try to get a thorough understanding of all that we may possibly do, in an honorable and legitimate way, to conserve wealth. Even to those who have inherited wealth, idleness can be a certain cause of ruin. A great fortune needs genuine labor for efficient administration. Those who leave this duty to strangers may pay a penalty for their negligence. This is why a rich man, who wants to create wealth, preserves and increase his fortune, should be his own business manager. Even artists must know the price that their work is worth.

It is necessary for the artist to be a businessman in order to have the right to be a genius. History is full of example of this. The great Shakespeare labored as a theatre manager to obtain the necessary leisure to produce his dramatic masterpieces. Edison worked as a telegraph operator to pay the bills while he “moonlighted” as an inventor. From the bottom to the top of the ladder, it is necessary to amass money in order to apply it to some great cause. Money is the means by which we may fulfill our purpose in a larger and better way.

Everyone should, in his own way, make an effort to amass some money. Some will apply money to their daily wants. Others seek to swell the fortune that they desire to leave to their children. Some only desire money so they can devote it to some noble enterprise or charity. Finally, a large number see money chiefly as a means of immediate gratification. Whatever the reason, everyone capable of earning money should learn how to manage it properly in order to ensure that they will have enough of it to apply to the causes that they choose.

Cite this page

https://graduateway.com/advantages-and-disadvantages-of-spending-money/

You can get a custom paper by one of our expert writers

- International business

- Business Model

- Economic problems

- Business Management

- Comparative advantage

- Conservation

- Procurement

- Mission Statement

- Cooperative

Check more samples on your topics

Spending time with family vs friends compare and contrast.

When you ask me about spending time with family or friends I’d definitely choose my Family. They are the most important people in my life. They are many things over times that have persuaded to choose family over my friends. I do not have to act or pretend to be neither someone nor something that

Spending Lives Avoiding Changes

Prompt: “Some people prefer to spend their lives doing the same things and avoiding change. Others, however, think that change is always a good thing.” It is clear that over time, everything undergoes change. There are various arguments discussing the benefits and drawbacks of embracing change in one's life and adapting to current situations. This

Spending My Vacation with Family

There are different ways how to spend your vacation. Many young people prefer to spend their vacation with friends. They are tired to see their parents every day. The idea is that parents rest without children and children do the same thing without their parents. However, there are families that like spending their vacation together.

What Children and Parents Learn by Spending Time Together

John Richardson is a worried man. He has been married to his wife for the last ten years and they have two children, John Junior, aged nine and Jane who is six years old. The father is employed as military cadet in the air force while the wife is an undersecretary in the department of

Effects of Disposable Income on Education Spending

Year 1990 was the worst of all time twelvemonth for the Indian economic system. Worst was seen when Indian Government had to plight its Gold militias to World Bank to seek loan. Trade shortage[ 1 ]and about belly-up authorities was compelled to believe of options. Policy form saw a major displacement from closed economic system

US Government Spending

Spending Throughout the 21 SST century, government spending has experienced many changes that have impacted the federal deficit, economic growth, and government policies. The united States government spending includes expenses such as pensions, health care, education, defense, welfare, protection, transportation, interest, and others. All of these expenses have increased over the last decade, while the

Public Schools Vs. Post-cold War Military Spending

The government's military spending today is comparable to the levels observed during the Cold War despite the absence of a Soviet Union threat. This excessive expenditure amounts to 86% of what was spent during that time, which seems unnecessary given the lack of an arms race. Although Americans acknowledge the importance of a strong military,

Spending Days Outdoor With Family and Friends as a Great Adventure

Spending days outdoor with family and friends can be a great adventure. If you are going first time for family camping or going with friends then here are some camping gears you must have with you. To have a good camping experience you must buy some important gears. Tent is basic camping gear; your whole camping depends

Power Is Money Money Is Power

Power is money and money is power. There are many more illustrations of this now than anytime in the yesteryear. One of the most obvious illustrations is political relations. Ross Perot was an unkown multimillionaire and his money is the lone ground that he made it into the presidential election. If a adult male who

Hi, my name is Amy 👋

In case you can't find a relevant example, our professional writers are ready to help you write a unique paper. Just talk to our smart assistant Amy and she'll connect you with the best match.

Advantages and disadvantages of having a lot of money

- IELTS Writing Task 2

IELTS Writing Task 2 with sample answer.

You should spend about 40 minutes on this task.

Some people say that money can make life easier and more comfortable. But others say that having a lot of money can bring some problems.

What do you think are the advantages and disadvantages of having a lot of money?

Give reasons for your answer and include any relevant examples from your own knowledge or experience.

Write at least 250 words.

Sample Answer: There is not a single shred of doubt that money plays the most vital role in the world we live in. Money makes the easier and far cosy. If one is lucky to have it, he is lucky. However, having a pile of money causes some advantage and disadvantage, as it is a double-edge sword. In the essay, I will discuss both the benefits and drawbacks of belonging plenty of money.

Several advantages stem from abundance of money. First of all, it makes someone’s life easier and comfortable as he can buy what make his life easy. He can lead a cosy life ensuring amenities. Secondly, the affluent man can contribute to the society. To give an illustration of what I mean, let us look at the issue of unemployment. He can create job opportunities by establishing industries. With mountains of money, a man, thus, could be savior of hundreds of unemployed youths. Another key thing to remember, in our capitalist society, the amount of money determines the social status of an individual. An individual with an abundance of money can enjoy a dignified social status.

However, like every other thing, money has dark side as well. More often, a great deal of money can change human behaviour. It can make people boastful. An amiable person may turn into an unpleasant individual. On the top of that, money often causes addiction to get more money. Thereby, a man can use unfair means to earn more money. The abundance of money, thus, could be catalyst in performing many evil acts.

All in all, everybody wants to money at any cost. In this modern world, money keeps us alive. Without it, we face multitudes of problems, while our life would be harmed with the pile of money. This is the dilemma of money, unfortunately.

IMAGES

COMMENTS

“Having money” means you own or possess some amount of currency, like dollars or euros. This money can be used to buy things you need or want, like food, toys, or clothes. It can also be saved for future use. What are the advantages and disadvantages of Having Money. The following are the advantages and disadvantages of Having Money:

May 12, 2023 · It is refutable that money can bring ease, comfort, and happiness to one’s life, however, the negative side of having too much money cannot be overlooked. This essay intends to discuss both pros and cons of having excess money | Band: 5.5

Aug 8, 2023 · While some people assert that wealth brings ease and comfort, others contend that an abundance of riches can lead to unforeseen troubles. In my view, the advantages of having a substantial amount of money far outweigh the disadvantages, as it enables individuals to access opportunities, alleviate financial stress, and contribute to society.

Read this article to learn about Advantages and Disadvantages of Money! Advantages of Money: Paper money has got several advantages and disadvantages. The following advantages can be mentioned: (i) Economical: Paper money practically costs nothing to the Government. Currency notes, therefore, are the cheapest media of exchange. If a country uses paper money, it need not spend anything on the ...

Advantages of Money. Facilitates trade and commerce – One of the primary advantages of money is that it enables us to buy and sell goods and services. Before money, people used to barter, which meant trading goods or services directly with each other. This process was often difficult and time-consuming.

Feb 19, 2024 · Money market accounts offer advantages such as relatively low risk, competitive interest rates, and the security of FDIC insurance for deposits. However, they may come with limitations and disadvantages, including restrictions on withdrawals and potential lower returns compared to riskier investments.

Jun 1, 2022 · Conclusion on Advantages and Disadvantages of Money. The advantages and disadvantages to having money are varied. However, one thing is for certain: if you want to achieve success in life, it’s hard to get it without a little green. For some people, making money may be easy but spending it may be difficult.

Mar 16, 2017 · Money originated as commodity money, but nearly all contemporary money systems are based on fiat money. Fiat money is without intrinsic use value as a physical commodity, and derives its value by being declared by a government to be legal tender; that is, it must be accepted as a form of payment within the boundaries of the country, for “all ...

Money is commonly accepted by people for exchange something. Every country has its own style of coin and paper money. For example, UK called dollar, Japanese called yen, Malaysia called Ringgit Malaysia and so on. Advantages of money is removal of barter system difficulties. Before people using money to buy the thing we wanted.

More often, a great deal of money can change human behaviour. It can make people boastful. An amiable person may turn into an unpleasant individual. On the top of that, money often causes addiction to get more money. Thereby, a man can use unfair means to earn more money. The abundance of money, thus, could be catalyst in performing many evil acts.