How to calculate a sales forecast for a new business

Table of Contents

Definition of a sales forecast

The uses of a sales forecast, how to calculate sales forecast for a new business, calculate a sales forecast using the accounts of your competition , calculate a sales forecast using a target market, manage your finances with countingup.

When you’re running a business, you should always keep one eye on the future. If you don’t have a rough idea of what the next week, month, or year might bring, you’ll be at a disadvantage when making business decisions. This means that calculating a sales forecast is essential, especially when you’re just starting a business or beginning to write a business plan .

Sales forecasting can be tough if you don’t have much business experience, but we’re here to help. This article will cover a range of different topics related to sales forecasting, including:

Creating a sales forecast is the first step in managing your company’s cash flow . Your cash flow is the movement of money in and out of your business. By forecasting your sales, you’ll be able to predict your gro s s profit and net profit , which means you can start anticipating what money you’ll have to spend on running your business for the next month.

Put simply, a sales forecast is a prediction of how much you’re going to sell in the coming month. This forecast doesn’t need to be a guess — it’s possible to calculate a fairly accurate forecast with some thorough research. The focus of your research will differ depending on which sales forecast method you pick.

Firstly, your sales forecast is important because it helps you set sales goals . Measuring the success of your business is a vital part of deciding its future, and setting sales goals is one of the simplest ways to measure success.

If you have an accurate sales forecast, you’ll be able to set realistic sales goals. You’ll want your goals to be realistic, as this will give the clearest picture of how well your company is doing and if significant changes are needed.

Similarly, sales forecasts can also help create an accurate budget for your business. As a sales forecast is essential for predicting the money your business will make, it also plays an important part in working out how much money you’ll have to spend.

Finally, sales forecasts help with finding investors for your business . If you’re looking for financial support to start your business, any investor you approach will likely be interested in the amount of money you expect the business to make. If you’ve created a sales forecast, you’ll be able to provide this information.

Large, well-established businesses rely on the sales figures of previous months to calculate their sales forecasts for the future. While having previous sales figures helps create more accurate forecasts, it’s not essential. There are a couple of methods new businesses can use to calculate their sales forecasts, even if they don’t have a sales history to look back at.

It’s always a good idea to research the competition when you’re setting up a new business. This is also true when calculating a sales forecast, but it depends on the type of businesses that make up your competition.

If any of your competitors are registered with the government as limited companies , they will have to make their accounts publicly available. These accounts will contain things like their monthly expenses, total profits, and (most importantly) the money they’ve made from sales.

Using this last figure, you can work out how much your competitors are making from sales each month, and get a reasonable estimate of your own sales. You can find these accounts by searching for your competitor’s business on Companies House .

Please note that this method isn’t effective if your competitors are sole traders , as this means they won’t need to publish their accounts publicly. In this instance, you should use the forecasting method below.

This method is known as ‘bottom-up’ forecasting, as you start at the bottom — your potential market of customers — and then work up to a forecast — the percentage of those customers that make a purchase.

The first step of this method is identifying your target market . This is the section of the population that you think will be interested in your product. With a little market research — things like sending out surveys, or posting polls on social media — you can work out how many people are in your target market.

Once you have the size of your target market, you need to make realistic estimates of how many people will make a purchase. For example, if 1000 people in the local area are potential customers, you should expect 10% to visit your store or website, and 1% to actually make a purchase.

This method of calculating a sales forecast is good because it’s very adaptable. If you get many more or far fewer sales than you originally calculated, then you can adjust your figures accordingly and record the new forecast.

It’s also a good idea to categorise this sort of sales forecast. Instead of estimating your overall sales, estimate the sales of each type of product you sell. That way, you can use the forecast to work out how many of each product to make or order each month.

Creating a sales forecast is a great start, but it’s only the first part of managing your sales revenue. Once you start making sales and money starts coming in, you’ll need to track that cash so you can work out where to spend it. If you think you might have trouble with this, try using a financial software tool like Countingup.

Countingup is the business current account with built-in accounting software that allows you to manage all your financial data in one place. With features like automatic expense categorisation, invoicing on the go, receipt capture tools, tax estimates, and cash flow insights, you can confidently keep on top of your business finances wherever you are.

You can also share your bookkeeping with your accountant instantly without worrying about duplication errors, data lags or inaccuracies. Seamless, simple, and straightforward! Find out more here .

- Counting Up on Facebook

- Counting Up on Twitter

- Counting Up on LinkedIn

Related Resources

When to incorporate a small business.

At the beginning of your small business journey, you need to choose a

Should I lease or buy equipment for my business?

What’s more valuable to you, control or flexibility? When deciding whether to lease

‘Customer’ vs ‘Client’: What’s the difference?

The main difference between a customer and a client is that a customer

Capital allowance vs. depreciation: how to explain the difference

The main difference between capital allowances and depreciation is that capital allowances allow

Budget vs forecast: What’s the difference?

The main difference between a budget and a forecast is that a budget

Debt vs equity: Advantages and disadvantages

The main difference between debt and equity financing is that debt involves borrowing

What is the difference between an invoice and a receipt?

As a small business owner or freelancer, you’ll have heard of receipts and

Operating profit vs EBIT: What’s the difference?

The main difference between operating profit and EBIT (Earnings Before Interest and Taxes)

Small business health checklist

Running a business can be a fairly hectic job. There’s often so much

What is financial reporting? 8 must-measure metrics for small businesses

Financial reporting is a crucial part of any business. After all, you need

Bookkeeping vs accounting: what’s the difference?

The main difference between bookkeeping and accounting is that bookkeeping focuses on recording

What is the difference between gross and net profit

Profit is categorised in two ways: gross and net. Each is important in

Sales | Templates

9 Free Sales Forecast Templates for Small Businesses in 2025

Published December 12, 2024

Published Dec 12, 2024

REVIEWED BY: Bianca Caballero

WRITTEN BY: Lorraine Daisy Resuello

This article is part of a larger series on Sales Management .

- 1. Simple Sales Projection Format Template

2. Long-term Sales Projection Forecast

3. budget sales projection template.

- 4. Month-to-month Sales Forecast Template

5. Individual Product/Service Sales Forecast Template

6. multiproduct sales forecast template, 7. retail sales forecast template, 8. subscription-based sales forecast template.

- 9. B2B Lead Sales Projection Format Template

CRMs With Built-in Sales Forecasting Features

Benefits of using sales forecasting templates, how to choose the right sales forecast template, bottom line.

Using a sales forecast, business owners can create realistic projections about incoming revenue and business performance based on their current data and past performance. Sales forecasts may cover weekly, monthly, annual, and multiannual projections and can be done using Google Sheets, Excel templates, or customer relationship management (CRM) software.

We’ve compiled nine free sales forecast templates you can download. Each downloadable file contains an example forecast you can use as a reference. We also included a blank template you can copy and fill in with your sales data.

Did You Know?

Sales forecasts create projections that can help you set goals, measure performance and budget, obtain financing, attract investors, and grow your business. So many parts of the business depend on forecasts, so it’s important to use software tools or a CRM system that gives you realistic, data-driven forecasts.

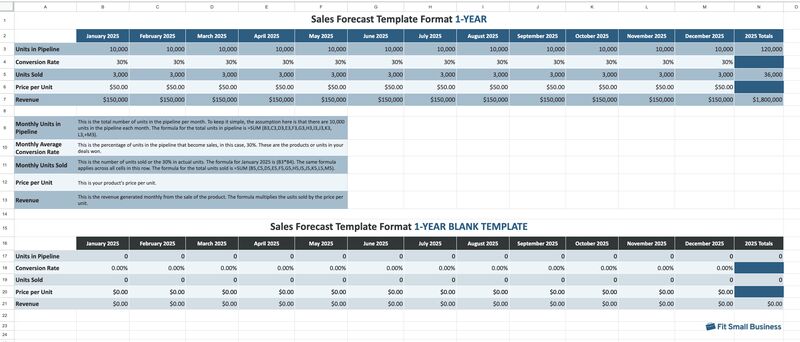

1. Simple Sales Projection Format in Excel and Google Sheets

Our free simple sales forecast template will help you get started with sales estimates to plan and grow your business. You can modify these one-year and multiyear projections in either Google Sheets or Excel. They can also generate future revenue estimates based on units sold, pipeline growth percentages, lead conversion rates, and your product pricing. This gives you an idea of how much your business can grow sales-wise in the next few years.

FILE TO DOWNLOAD OR INTEGRATE

FREE Sales Forecasting Template: One-Year

Thank you for downloading!

Sales teams can use a one-year sales projection format in Excel or Google Sheets to monitor performance, identify trends, plan inventory needs, and make informed decisions.

FREE Sales Forecasting Template: Multiyear

💡 Quick Tip:

Use customer relationship management (CRM) software to easily forecast sales by using customer data stored in the system. Providers like HubSpot allow you to generate revenue projections based on a specific period of time.

Visit HubSpot

Salespeople can use a multiyear sales projection format in Excel or Google Sheets to track performance against targets, identify trends, plan inventory needs, and make informed decisions.

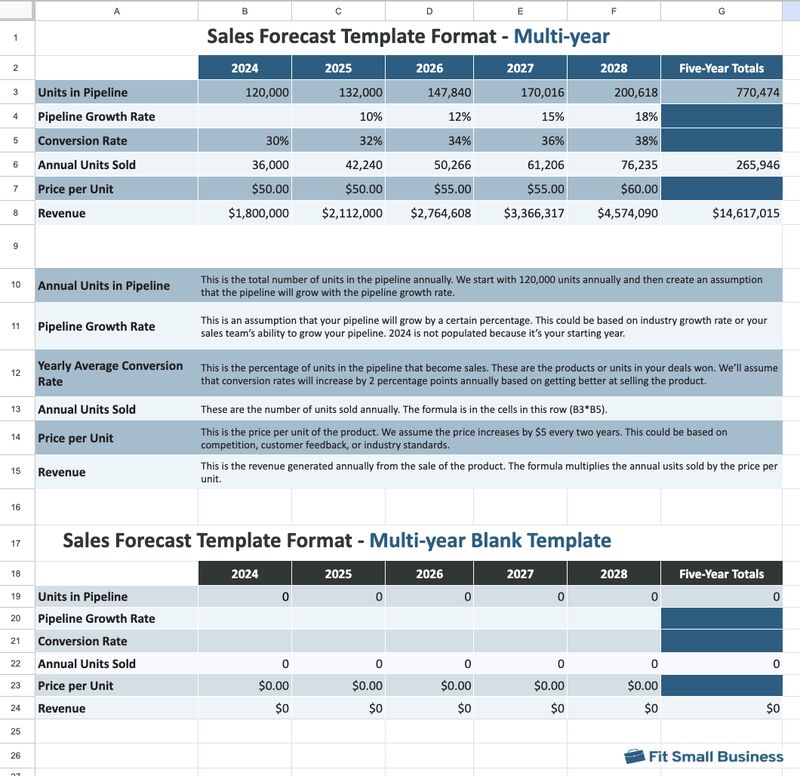

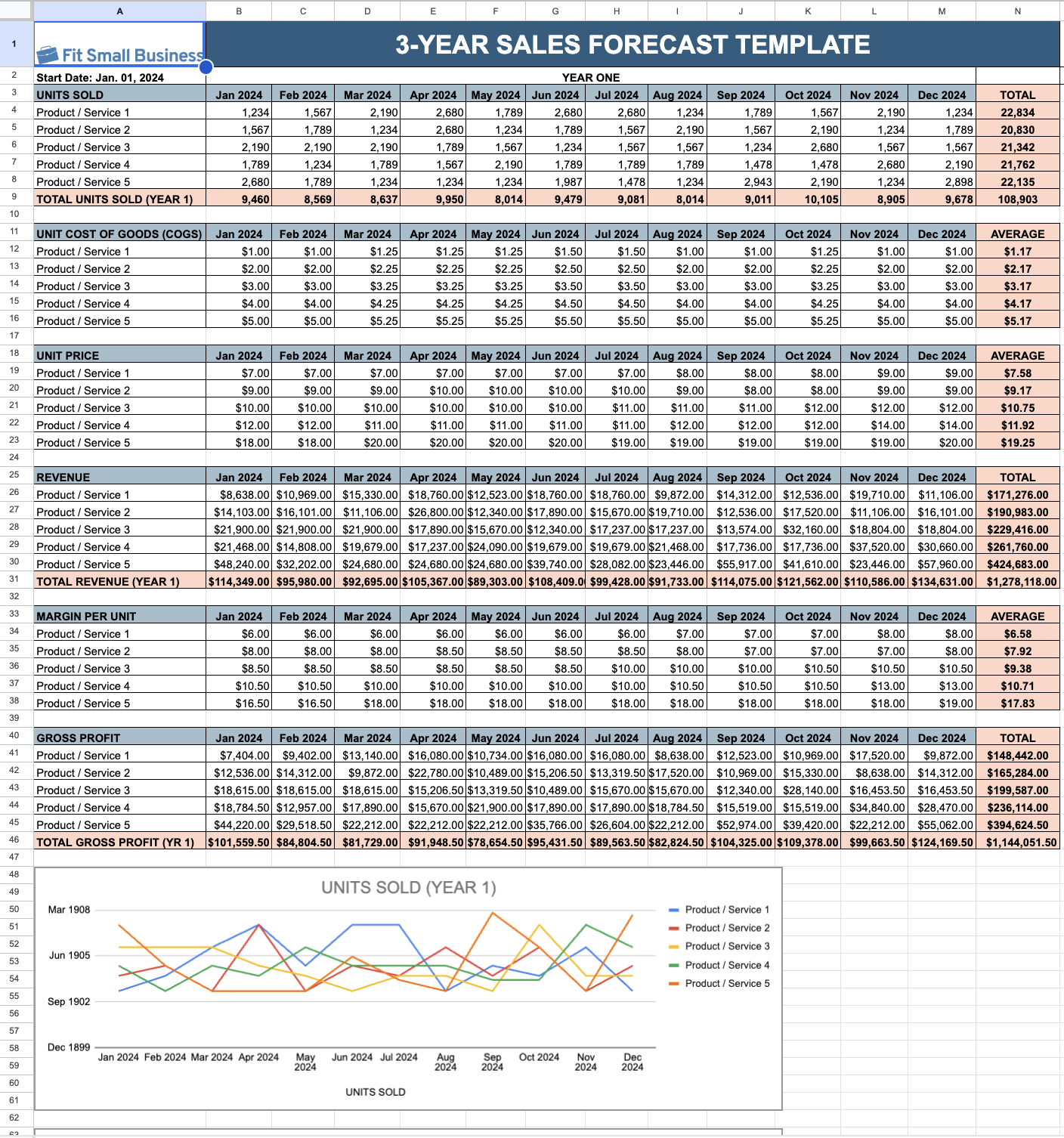

Part of creating a sales plan is forecasting long-term revenue goals and sales projections and then laying out the strategies and tactics you’ll use to hit your performance goals. Long-term sales projection templates usually provide three- to five-year projections. These templates are accessible in both Excel and Google Sheets.

Long-term sales prediction templates are best for businesses looking to scale and that want insights about how much working capital they can expect to tap into for growth initiatives. This type of sales projection template is also often required when applying for commercial loans or funding through outside investors or crowdfunding.

FREE 3-Year Forecast Template

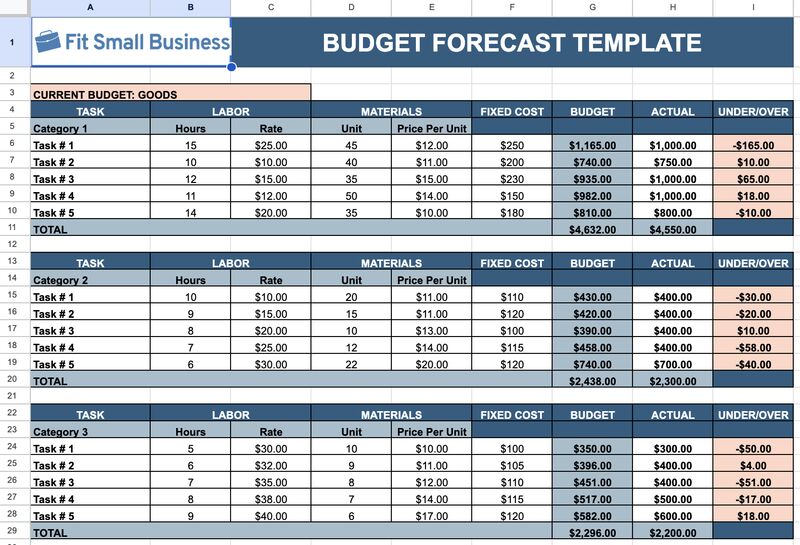

A budget sales forecast template shows expense estimates in relation to revenue, allowing you to calculate how much you can spend during a specified period. Budget templates will enable you to enter income projections and available cash to indicate your spending capabilities for that time frame.

This type of template is best for new and growing businesses trying to figure out their future available expenditures. Additionally, businesses interested in purchasing a large asset, such as a company vehicle, piece of equipment, or commercial real estate, can use this template to see how much of the asset can be self-financed.

FREE Budget Sales Forecast Template

Sales managers can use a budget sales projection Excel template to align sales goals with financial resources and monitor performance against budgeted targets.

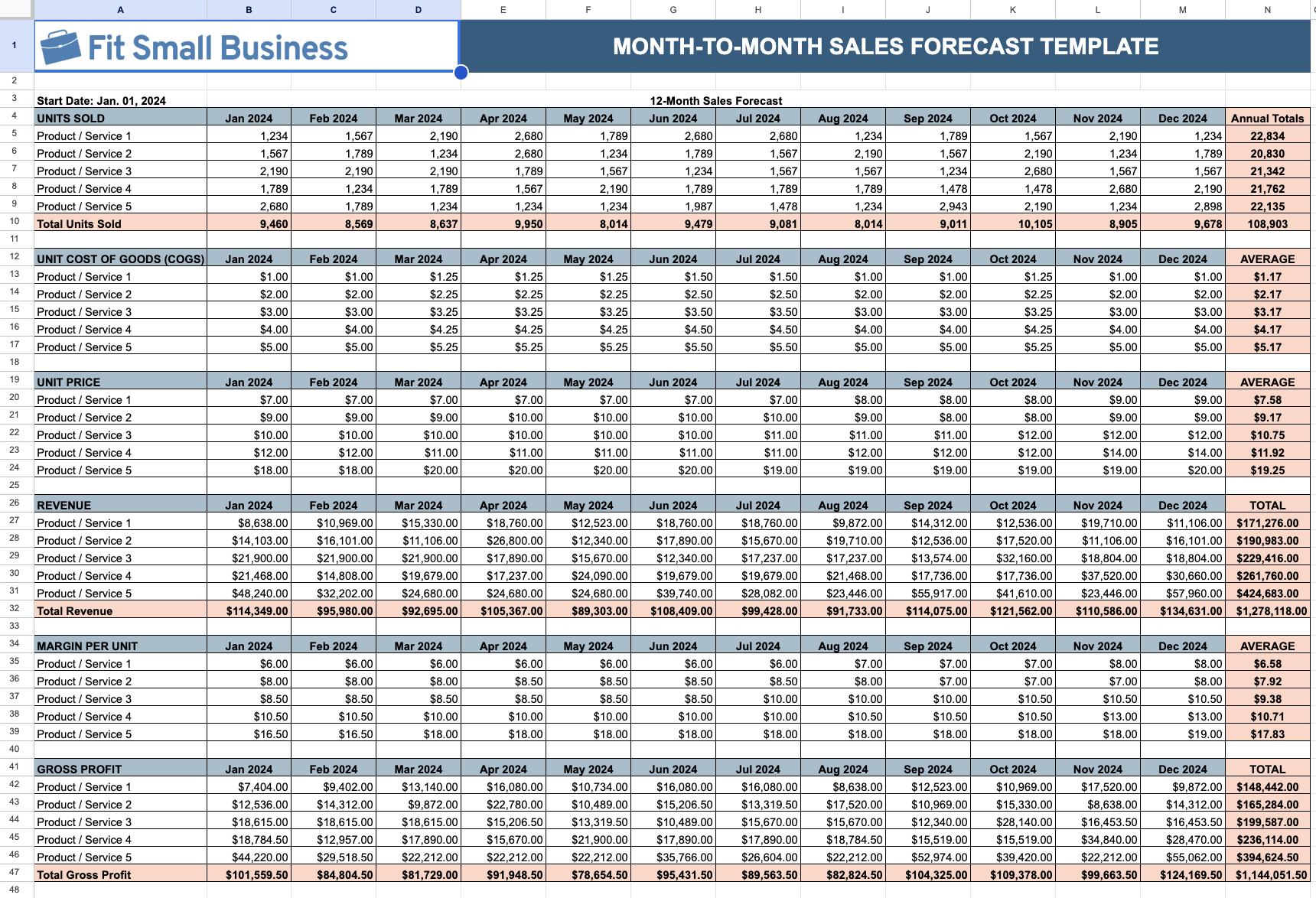

4. Month-to-Month Sales Forecast Template

The month-to-month sales projection template shows sales projections for a year divided into monthly increments. This type of revenue forecast template makes it easier to estimate your incoming revenue because you can break down your pricing model, such as the average number of units sold, monthly rather than annually.

FREE Month-to-Month Forecast Template

Sales teams can use a month-to-month sales forecast Excel template to track short-term performance and adjust tactics based on real-time data.

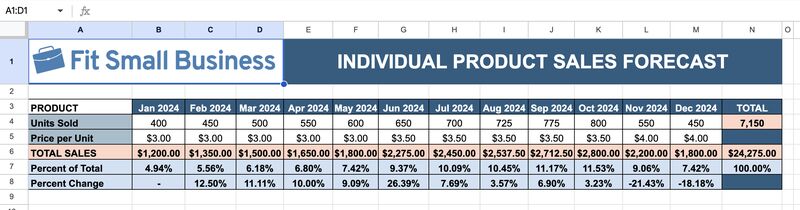

Businesses that sell one product or service can use an individual sales projection template to project sales of a new (or any single) product or service. This forecast indicates how you expect the product to perform based on units sold and the price per unit monthly.

An individual product forecast template benefits businesses that sell products through a physical storefront or online. It helps businesses adding a new product to their arsenal estimate sales exclusively for that product. It is also recommended for companies that need to track individual performance for the most popular or profitable products.

FREE Individual Product Forecast Template

Sales reps can use an individual product forecast template to predict sales, track performance, and adjust strategies for specific products.

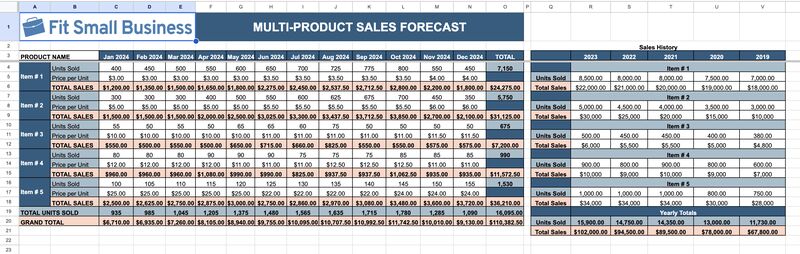

Use this revenue projection template to generate sales projections if your business sells multiple products. Through this type of template, you can compare the estimated performance of specific products by tracking the units sold and the price per unit. In turn, this will yield a total sales revenue estimate.

The multiproduct forecasting template is best for retail or wholesale businesses selling various products. You can also use it to project the revenue of multiple product categories. Each “item” represents a category rather than an individual product, and the price per unit is calculated in aggregate.

FREE Multiproduct Forecast Template

A multiproduct forecast template can help track and predict sales across multiple products, prioritize efforts, and optimize inventory and resource allocation.

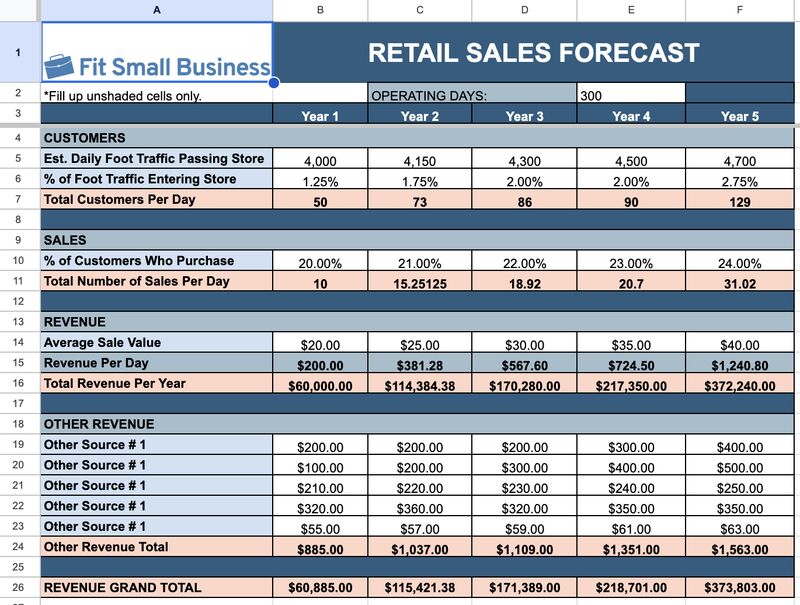

A retail sales projection template forecasts revenue for brick-and-mortar stores since it includes data related to foot traffic. The retail sales template calculates projected revenue by year based on the percentage of foot traffic that enters the store and the scale of conversions or those who make a purchase. Since it has a field for “other revenue,” it can be used by retail stores selling online.

This business forecast template is mainly designed for brick-and-mortar retail businesses. However, multichannel ecommerce and brick-and-mortar businesses can also use this forecast template (just add ecommerce sales under other revenue). Or replace “Est. daily foot traffic passing stores” with “website traffic” to convert this sales forecast Excel sheet into an ecommerce sales forecasting template.

FREE Retail Forecast Template

A retail sales forecast template helps businesses predict sales, manage inventory, and plan marketing strategies.

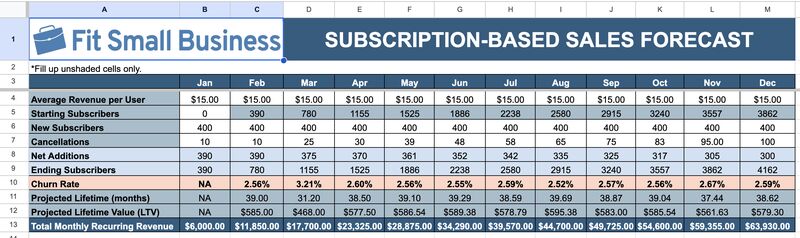

Businesses relying on recurring revenue from sign-ups or contract renewals should use the subscription-based sales prediction spreadsheet. Enter data into the visitor and sign-up fields to show the visitor-to-sign-up conversion rate. Then, enter the number of new customers to show the percentage of sign-ups that convert to paying customers.

This business projection template also helps you track customer churn. It calculates your churn and retention rate based on the number of paying customers at the end of the period compared with the number at the beginning, plus the number of new customers added. Knowing your churn rate is essential since a high or increasing rate of customer turnover could indicate problems with your organization or its products or services.

The fields of this template can be altered for use by contract renewal businesses like insurance agencies, information technology (IT) companies, and payroll processors. For example, subscribers can be replaced with “leads,” and new subscribers can be replaced with “presentations,” “free trials,” or “demos.” Then, change the churn rate to “nonrenewed contracts” to estimate new and recurring business revenue year-to-year.

FREE Subscription-based Forecast Template

A subscription-based forecast template helps businesses predict recurring revenue, track subscriber growth, and manage retention strategies.

How to Calculate Your Churn Rate:

Divide the number of lost customers by the total customers at the start of the time period, then multiply the result by 100. For example, if your business had 200 customers at the beginning of January and lost 12 customers by the end, you would divide 12 by 200 to get 0.06. Multiply that by 100, and 6% is your monthly churn rate.

% Churn = (Total Number of Customers Lost/Total Number of Customers) × 100

Churn Rate Calculator

Manual calculation of monthly customer churn rate

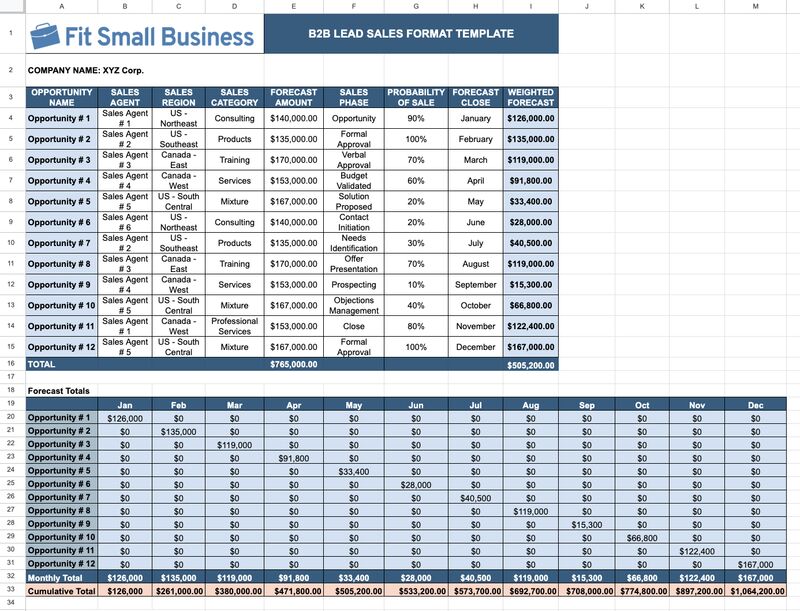

9. B2B Lead Sales Projection Format in Excel and Google Sheets

A business-to-business (B2B) lead forecast template estimates sales revenue from current deal opportunities in the sales pipeline through business leads. Businesses can use estimated deal values and the percent chance of closing those deals to obtain a sales projection.

This revenue projection template is best for B2B organizations or businesses selling to other businesses or organizations rather than business-to-consumer (B2C) organizations. It can also be used for direct sales prospecting activities and businesses that submit business proposals in response to solicitation requests. Download our free sales projection format in Excel and Google Sheets to save time and effort.

FREE B2B Lead Forecast Template

A B2B lead forecast template helps businesses predict lead generation, track conversion rates, and optimize sales strategies for B2B sales pipelines.

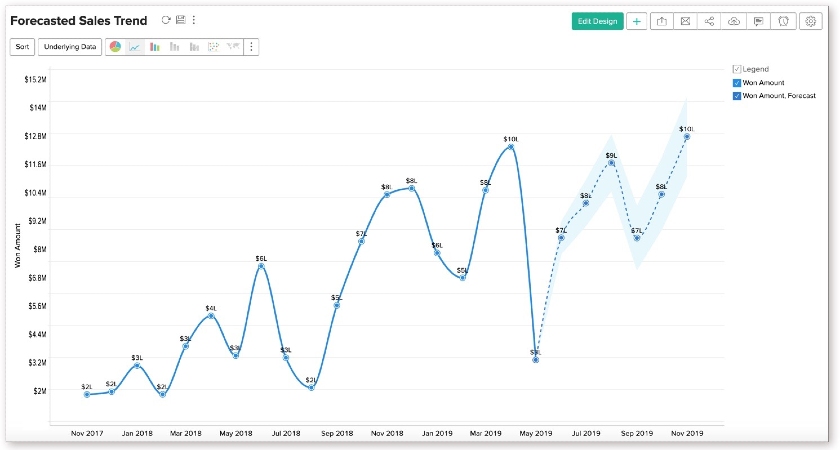

Sales forecast sample templates are easy to modify. However, customer relationship management (CRM) systems generally offer more robust tools for managing revenue opportunities that can be converted into sales forecasts. They are valuable tools for providing sales predictions on premade charts through the data collected in the system. Below are examples of CRM platforms that could double as great sales forecasting software.

- HubSpot CRM

HubSpot CRM can instantly create revenue projections or automatically produce these reports for you monthly or quarterly at no additional cost, saving you time and helping your business stay on track.

Starting price: Free for two users or $15 per user per month with annual billing.

HubSpot deal forecasting (Source: HubSpot)

Visit HubSpot CRM

Pipedrive can take information such as potential deal value and probability of closing for a lead or opportunity to provide sales estimates in highly customizable templates.

Starting price: $14 per user per month with annual billing.

Users can easily generate sales prediction reports on HubSpot with historical data. (Source: HubSpot)

Visit Pipedrive

Zoho CRM provides sales forecasting through its native integration with Zoho Analytics, which analyzes and visualizes the data. Users can customize their forecasts by viewing them on different visual channels, including line, bar, and scatter charts. Providing the right tools for your sales team to organize leads, communicate with prospects, and analyze sales data is crucial for streamlining sales management .

Starting price: Free for three users or $14 per user per month with annual billing.

Zoho Analytics sales prediction (Source: Zoho)

Visit Zoho CRM

Sales forecasting can help small business owners understand their revenue potential, align their resources effectively, and make data-driven decisions. Sales forecasting templates are a key tool for streamlining this process. Here are five key benefits of sales forecasting supported by recent statistical findings.

1. Improved Accuracy in Sales Projections

About 80% of sales and finance leaders have missed a sales forecast in the past year. This data highlights the challenge many face in making accurate projections, which could result in missed sales opportunities. Sales forecasting templates integrate historical data, trends, and industry benchmarks to help business owners and managers generate more reliable sales and overall revenue projections.

2. Enhanced Resource Allocation

Sales operations leaders can improve forecasts by using revenue projection templates and integrating predictive analytics. These tools enable the visualization of trends and real-time adjustments to sales and marketing strategies, optimizing resources such as personnel, budget, and inventory.

For example, a sales team using predictive analytics can predict a 30% drop in demand for winter apparel by late February because of unseasonably warm weather. This insight allows them to shift their budget toward promoting spring collections earlier than planned and reassign staff from winter-focused sales regions to areas where demand for transitional clothing is growing.

3. Streamlined Decision-making

Artificial intelligence (AI) has the potential to increase corporate profits by up to $4.4 trillion annually . The majority of potential value in high-tech industries stems from generative AI’s capability to accelerate and streamline software development processes. AI boosts performance in key areas, like marketing and customer interactions. Leveraging AI-powered predictive analytics and sales forecasting templates enables sales leaders to make faster, more informed decisions.

The data-driven insights allow teams to pivot strategies rapidly to meet shifting customer and market demands. For example, a sales team using AI-powered predictive analytics can detect an upcoming surge in demand for fitness equipment ahead of the New Year. This allows them to adjust marketing campaigns, increase inventory levels, and assign sales reps to high-demand regions.

4. Improved Sales Team Alignment

Sales forecasting templates help align sales teams with other departments. CRMs with forecasting tools, like analytical reports, improve cross-functional collaboration and reduce miscommunication. For example, a sales manager predicts a 63% increase in demand for a new software product in the next quarter. With this insight, the marketing team can quickly adjust digital campaigns to target the right audience, while the customer support team can prepare by increasing staff levels.

5. Increased Revenue and Profitability

Sales forecasting is key to driving revenue, but 66% of sales professionals struggle because of reporting systems that can’t access historical CRM or performance data. CRM sales forecasting software with templates can help sales teams overcome this challenge. This means more accurate targets, better resource allocation, and improved performance tracking.

For example, a sales team using CRM revenue forecasting software notices that a particular line of smartphone cases has a 40% increase in sales every holiday season. With this in mind, salespeople can work with marketers to ramp up advertising in advance and ensure that inventory levels are increased to meet the expected demand.

Choosing the right sales projection format in Excel or Google Sheets is crucial to making accurate and actionable predictions to drive your small business forward. Below are some tips to help you get started.

1. Define Your Forecasting Needs

Identify the core requirements of your sales forecast by considering the time horizon (monthly, quarterly, or annual). The level of detail (high-level vs granular by region or salesperson) and the type of forecast you need (sales volume, revenue, or both) are also important considerations to ensure a seamless sales process.

2. Consider Your Sales Cycle and Data Sources

A short sales cycle (common in B2C sales) requires a more dynamic and frequent template updating process. On the other hand, a longer cycle (common in B2B sales) calls for pipeline-based forecasting that accounts for deal stages over time. Sales templates that integrate with existing data sources, such as CRM systems, enable automated info input and provide accurate insights for efficient operations.

3. Evaluate Template Customization and Features

Look for templates that allow customization based on your specific sales process. The ability to add custom fields, adjust assumptions, and use formulas for more accurate forecasting is essential. Add graphs, charts, or pivot tables for more effective data and trend analysis. Scenario planning options (best-case vs worst-case) can help sales teams create more flexible forecasts.

4. Test for Ease of Use and Collaboration

Choose a template that is easy to use and update regularly. The best ones don’t require complex calculations and have easy-to-fill data fields. It’s also best to use a template with multiuser access, version control, and the ability to add comments for seamless collaboration.

5. Plan for Scalability and Flexibility

As your business grows, your forecasting needs evolve. For instance, as you launch new products, you’ll need an additional forecast to determine demand. Therefore, we highly recommend choosing scalable forecasting templates through a spreadsheet or built-in software like a CRM.

Frequently Asked Questions (FAQs)

What is a sales forecast template.

A sales forecast template is a predesigned spreadsheet that allows businesses to project their future sales revenue for a specific period. It’s typically based on historical sales data and market trends. It also includes various factors that may potentially affect future sales performance, such as new product launches, seasonality, economic conditions, and changes in consumer behavior.

How do you create a sales forecast?

To create a sales forecast, first gather and analyze past sales data to identify trends, seasonality, and patterns. Then, apply forecasting methods like moving averages or regression analysis to predict future sales. Next, incorporate market research and insights from your sales team to refine the forecast, considering market conditions or upcoming product launches. Finally, regularly update the forecast by comparing actual sales with predictions and adjusting for changes in the market or business environment to ensure its accuracy over time.

What is the formula for sales forecast?

The formula for a sales forecast typically varies depending on the method, but a simple approach multiplies your average sales per period by the number of periods.

Sales Forecast = (Average Sales per Period) × (Number of Periods)

How to do sales forecasting in Excel?

To perform sales forecasting in Excel, first gather your past sales data by date (e.g., monthly or quarterly). Then, use Excel functions like AVERAGE, TREND, or FORECAST.LINEAR to calculate future sales. Next, create a time series chart to visualize sales trends over time. Finally, update the forecast regularly with actual sales data to refine predictions and maintain accuracy.

Business forecast templates are available in both Excel and Google Sheets that you can download and customize. You may also take advantage of CRM features that organize, estimate, and visualize your company’s sales information, including sales predictions. A CRM can save sales reps time making projections and optimize your sales pipeline to generate leads and close more deals.

About the Author

Find Lorraine Daisy On LinkedIn

Lorraine Daisy Resuello

Lorraine Daisy Resuello is a specialist at Fit Small Business who focuses on Sales and Customer Service topics. Before joining FSB, she worked as a freelance writer covering technology, digital marketing, and business topics. She collaborated with companies in the US, UK, Canada, Singapore, and the Philippines. Additionally, she has experience in customer service in business process outsourcing (BPO). At present, she uses her decade-long writing experience to provide FSB readers with the best answers to their questions.

Join Fit Small Business

Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. Select the newsletters you’re interested in below.

🎧 Real entrepreneurs. Real stories.

Subscribe to The Hurdle podcast today!

How to Create a Sales Forecast

11 min. read

Updated October 27, 2023

Business owners are often afraid to forecast sales. But, you shouldn’t be. Because you can successfully forecast your own business’s sales.

You don’t have to be an MBA or CPA. It’s not about some magic right answer that you don’t know. It’s not about training you don’t have. It doesn’t take spreadsheet modeling (much less econometric modeling) to estimate units and price per unit for future sales. You just have to know your own business.

Forecasting isn’t about seeing into the future

Sales forecasting is much easier than you think and much more useful than you imagine.

I was a vice president of a market research firm for several years, doing expensive forecasts, and I saw many times that there’s nothing better than the educated guess of somebody who knows the business well. All those sophisticated techniques depend on data from the past — and the past, by itself, isn’t the best predictor of the future. You are.

It’s not about guessing the future correctly. We’re human; we don’t do that well. Instead, it’s about setting down assumptions, expectations, drivers, tracking, and management. It’s about doing your job, not having precognitive powers.

- Successful forecasting is driven by regular reviews

What really matters is that you review and revise your forecast regularly. Spending should be tied to sales, so the forecast helps you budget and manage. You measure the value of a sales forecast like you do anything in business, by its measurable business results.

That also means you should not back off from forecasting because you have a new product, or new business, without past data. Lay out the sales drivers and interdependencies, to connect the dots, so that as you review plan-versus-actual results every month, you can easily make course corrections.

If you think sales forecasting is hard, try running a business without a forecast. That’s much harder.

Your sales forecast is also the backbone of your business plan . People measure a business and its growth by sales, and your sales forecast sets the standard for expenses , profits, and growth. The sales forecast is almost always going to be the first set of numbers you’ll track for plan versus actual use, even if you do no other numbers.

If nothing else, just forecast your sales, track plan-versus-actual results, and make corrections — that process alone, just the sales forecast and tracking is in itself already business planning. To get started on building your forecast follow these steps.

And if you run a subscription-based business, we have a guide dedicated to building a sales forecast for that business model.

- Step 1: Set up your lines of sales

Most forecasts show several distinct lines of sales. Ideally, your sales lines match your accounting, but not necessarily in the same level of detail.

For example, a restaurant ought not to forecast sales for each item on the menu. Instead, it forecasts breakfasts, lunches, dinners, and drinks, summarized. And a bookstore ought not to forecast sales by book, and not even by topic or author, but rather by lines of sales such as hardcover, softcover, magazines, and maybe categories (such as fiction, non-fiction, travel, etc.) if that works.

Always try to set your streams to match your accounting, so you can look at the difference between the forecast and actual sales later. This is excellent for real business planning. It makes the heart of the process, the regular review, and revision, much easier. The point is better management.

For instance, in a bicycle retail store business plan, the owner works with five lines of sales, as shown in the illustration here.

In this sample case, the revenue includes new bikes, repair, clothing, accessories, and a service contract. The bookkeeping for this retail store tracks sales in those same five categories.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- Step 2: Forecast line by line

There are many ways to forecast a line of sales.

The method for each row depends on the business model

Among the main methods are:.

- Unit sales : My personal favorite. Sales = units times price. You set an average price and forecast the units. And of course, you can change projected pricing over time. This is my favorite for most businesses because it gives you two factors to act on with course corrections: unit sales, or price.

- Service units : Even though services don’t sell physical units, most sell billable units, such as billable hours for lawyers and accountants, or trips for transportations services, engagements for consultants, and so forth.

- Recurring charges : Subscriptions. For each month or year, it has to forecast new signups, existing monthly charges, and cancellations. Estimates depend on both new signups and cancellations, which is often called “churn.”

- Revenue only : For those who prefer to forecast revenue by the stream as just the money, without the extra information of breaking it into units and prices.

Most sales forecast rows are simple math

For a business plan, I recommend you make your sales forecast a detailed look at the next 12 months and then broadly cover two years after that. Here’s how to approach each method of line-by-line forecasting.

Start with units if you can

For unit sales, start by forecasting units month by month, as shown here below for the new bike’s line of sales in the bicycle shop plan:

I recommend looking at the visual as you forecast the units because most of us can see trends easier when we look at the line, as shown in the illustration, rather than just the numbers. You can also see the numbers in the forecast near the bottom. The first year, fiscal 2021 in this forecast, is the sum of those months.

Estimate price assumptions

With a simple revenue-only assumption, you do one row of units as shown in the above illustration, and you are done. The units are dollars, or whatever other currency you are using in your forecast. In this example, the new bicycle product will be sold for an average of $550.00.

That’s a simplifying assumption, taking the average price, not the detailed price for each brand or line. Garrett, the shop owner, uses his past results to determine his actual average price for the most recent year. Then he rounds that estimate and adds his own judgment and educated guess on how that will change.

Multiply price times units

Multiplying units times the revenue per unit generates the sales forecast for this row. So for example the $18,150 shown for October of 2020 is the product of 33 units times $550 each. And the $21,450 shown for the next month is the product of 39 units times $550 each.

Subscription models are more complicated

Lately, a lot of businesses offer their buyers subscriptions, such as monthly packages, traditional or online newspapers, software, and even streaming services. All of these give a business recurring revenues, which is a big advantage.

For subscriptions, you normally estimate new subscriptions per month and canceled subscriptions per month, and leave a calculation for the actual subscriptions charged. That’s a more complicated method, which demands more details.

For that, you can refer to detailed discussions on subscription forecasting in How to Forecast Sales for a Subscription Business .

- But how do you know what numbers to put into your sales forecast?

The math may be simple, yes, but this is predicting the future, and humans don’t do that well. So, don’t try to guess the future accurately for months in advance.

Instead, aim for making clear assumptions and understanding what drives your sales, such as web traffic and conversions, in one example, or the direct sales pipeline and leads, in another. Review results every month, and revise your forecast. Your educated guesses become more accurate over time.

Experience in the field is a huge advantage

In a normal ongoing business, the business owner has ample experience with past sales. They may not know accounting or technical forecasting, but they know their business. They are aware of changes in the market, their own business’s promotions, and other factors that business owners should know. They are comfortable making educated guesses.

If you don’t personally have the experience, try to find information and make guesses based on the experience of an employee, your mentor , or others you’ve spoken within your field.

Use past results as a guide

Use results from the recent past if your business has them. Start a forecast by putting last year’s numbers into next year’s forecast, and then focus on what might be different this year from next.

Do you have new opportunities that will make sales grow? New marketing activities, promotions? Then increase the forecast. New competition, and new problems? Nobody wants to forecast decreasing sales, but if that’s likely, you need to deal with it by cutting costs or changing your focus.

Look for drivers

To forecast sales for a new restaurant, first, draw a map of tables and chairs and then estimate how many meals per mealtime at capacity, and in the beginning. It’s not a random number; it’s a matter of how many people come in.

To forecast sales for a new mobile app, you might get data from the Apple and Android mobile app stores about average downloads for different apps. A good web search might also reveal some anecdotal evidence, blog posts, and news stories, about the ramp-up of existing apps that were successful.

Get those numbers and think about how your case might be different. Maybe you drive downloads with a website, so you can predict traffic from past experience and then assume a percentage of web visitors who will download the app.

- Estimate direct costs

Direct costs are also called the cost of goods sold (COGS) and per-unit costs. Direct costs are important because they help calculate gross margin, which is used as a basis for comparison in financial benchmarks, and are an instant measure (sales less direct costs) of your underlying profitability.

For example, I know from benchmarks that an average sporting goods store makes a 34 percent gross margin. That means that they spend $66 on average to buy the goods they sell for $100.

Not all businesses have direct costs. Service businesses supposedly don’t have direct costs, so they have a gross margin of 100 percent. That may be true for some professionals like accountants and lawyers, but a lot of services do have direct costs. For example, taxis have gasoline and maintenance. So do airlines.

A normal sales forecast includes units, price per unit, sales, direct cost per unit, and direct costs. The math is simple, with the direct costs per unit related to total direct costs the same way price per unit relates to total sales.

Multiply the units projected for any time period by the unit direct costs, and that gives you total direct costs. And here too, assume this view is just a cut-out, it flows to the right. In this example, Garrett the shop owner projected the direct costs of new bikes based on the assumption of 49 percent of sales.

Given the unit forecast estimate, the calculation of units times direct costs produces the forecast shown in the illustration below for direct costs for that product. So therefore the projected direct costs for new bikes in October is $8,894, which is 49% of the projected sales for that month, $18,150.

- Never forecast in a vacuum

Never think of your sales forecast in a vacuum. It flows from the strategic action plans with their assumptions, milestones , and metrics. Your marketing milestones affect your sales. Your business offering milestones affect your sales.

When you change milestones—and you will, because all business plans change—you should change your sales forecast to match.

- Timing matters

Your sales are supposed to refer to when the ownership changes hands (for products) or when the service is performed (for services). It isn’t a sale when it’s ordered, or promised, or even when it’s contracted.

With proper accrual accounting , it is a sale even if it hasn’t been paid for. With so-called cash-based accounting, by the way, it isn’t a sale until it’s paid for. Accrual is better because it gives you a more accurate picture, unless you’re very small and do all your business, both buying and selling, with cash only.

I know that seems simple, but it’s surprising how many people decide to do something different. The penalty for doing things differently is that then you don’t match the standard, and the bankers, analysts, and investors can’t tell what you meant.

This goes for direct costs, too. The direct costs in your monthly profit and loss statement are supposed to be just the costs associated with that month’s sales. Please notice how, in the examples above, the direct costs for the sample bicycle store are linked to the actual unit sales.

- Live with your assumptions

Sales forecasting is not about accurately guessing the future. It’s about laying out your assumptions so you can manage changes effectively as sales and direct costs come out different from what you expected. Use this to adjust your sales forecast and improve your business by making course corrections to deal with what is working and what isn’t.

I believe that even if you do nothing else, by the time you use a sales forecast and review plan versus actual results every month, you are already managing with a business plan . You can’t review actual results without looking at what happened, why, and what to do next.

Tim Berry is the founder and chairman of Palo Alto Software , a co-founder of Borland International, and a recognized expert in business planning. He has an MBA from Stanford and degrees with honors from the University of Oregon and the University of Notre Dame. Today, Tim dedicates most of his time to blogging, teaching and evangelizing for business planning.

Table of Contents

- Forecasting isn’t about seeing into the future

Related Articles

5 Min. Read

How to Highlight Risks in Your Business Plan

1 Min. Read

How to Calculate Return on Investment (ROI)

7 Min. Read

7 Financial Terms Small Business Owners Need to Know

3 Min. Read

What Is a Break-Even Analysis?

The LivePlan Newsletter

Become a smarter, more strategic entrepreneur.

Your first monthly newsetter will be delivered soon..

Unsubscribe anytime. Privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

Everything that you need to know to start your own business. From business ideas to researching the competition.

Practical and real-world advice on how to run your business — from managing employees to keeping the books

Our best expert advice on how to grow your business — from attracting new customers to keeping existing customers happy and having the capital to do it.

Entrepreneurs and industry leaders share their best advice on how to take your company to the next level.

- Business Ideas

- Human Resources

- Business Financing

- Growth Studio

- Ask the Board

Looking for your local chamber?

Interested in partnering with us?

Run » finance, how to create a financial forecast for a startup business plan.

Financial forecasting allows you to measure the progress of your new business by benchmarking performance against anticipated sales and costs.

When starting a new business, a financial forecast is an important tool for recruiting investors as well as for budgeting for your first months of operating. A financial forecast is used to predict the cash flow necessary to operate the company day-to-day and cover financial liabilities.

Many lenders and investors ask for a financial forecast as part of a business plan; however, with no sales under your belt, it can be tricky to estimate how much money you will need to cover your expenses. Here’s how to begin creating a financial forecast for a new business.

[Read more: Startup 2021: Business Plan Financials ]

Start with a sales forecast

A sales forecast attempts to predict what your monthly sales will be for up to 18 months after launching your business. Creating a sales forecast without any past results is a little difficult. In this case, many entrepreneurs make their predictions using industry trends, market analysis demonstrating the population of potential customers and consumer trends. A sales forecast shows investors and lenders that you have a solid understanding of your target market and a clear vision of who will buy your product or service.

A sales forecast typically breaks down monthly sales by unit and price point. Beyond year two of being in business, the sales forecast can be shown quarterly, instead of monthly. Most financial lenders and investors like to see a three-year sales forecast as part of your startup business plan.

Lower fixed costs mean less risk, which might be theoretical in business schools but are very concrete when you have rent and payroll checks to sign.

Tim Berry, president and founder of Palo Alto Software

Create an expenses budget

An expenses budget forecasts how much you anticipate spending during the first years of operating. This includes both your overhead costs and operating expenses — any financial spending that you anticipate during the course of running your business.

Most experts recommend breaking down your expenses forecast by fixed and variable costs. Fixed costs are things such as rent and payroll, while variable costs change depending on demand and sales — advertising and promotional expenses, for instance. Breaking down costs into these two categories can help you better budget and improve your profitability.

"Lower fixed costs mean less risk, which might be theoretical in business schools but are very concrete when you have rent and payroll checks to sign," Tim Berry, president and founder of Palo Alto Software, told Inc . "Most of your variable costs are in those direct costs that belong in your sales forecast, but there are also some variable expenses, like ads and rebates and such."

Project your break-even point

Together, your expenses budget and sales forecast paints a picture of your profitability. Your break-even projection is the date at which you believe your business will become profitable — when more money is earned than spent. Very few businesses are profitable overnight or even in their first year. Most businesses take two to three years to be profitable, but others take far longer: Tesla , for instance, took 18 years to see its first full-year profit.

Lenders and investors will be interested in your break-even point as a projection of when they can begin to recoup their investment. Likewise, your CFO or operations manager can make better decisions after measuring the company’s results against its forecasts.

[Read more: Startup 2021: Writing a Business Plan? Here’s How to Do It, Step by Step ]

Develop a cash flow projection

A cash flow statement (or projection, for a new business) shows the flow of dollars moving in and out of the business. This is based on the sales forecast, your balance sheet and other assumptions you’ve used to create your expenses projection.

“If you are starting a new business and do not have these historical financial statements, you start by projecting a cash-flow statement broken down into 12 months,” wrote Inc . The cash flow statement will include projected cash flows from operating, investing and financing your business activities.

Keep in mind that most business plans involve developing specific financial documents: income statements, pro formas and a balance sheet, for instance. These documents may be required by investors or lenders; financial projections can help inform the development of those statements and guide your business as it grows.

CO— aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

Follow us on Instagram for more expert tips & business owners’ stories.

CO—is committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here .

Subscribe to our newsletter, Midnight Oil

Expert business advice, news, and trends, delivered weekly

By signing up you agree to the CO— Privacy Policy. You can opt out anytime.

For more finance tips

Get ahead this tax season: small business credits, deductions, and updated guidance, assets vs. expenses: understanding the difference and why it matters, how to create a financial projection in excel.

By continuing on our website, you agree to our use of cookies for statistical and personalisation purposes. Know More

Welcome to CO—

Designed for business owners, CO— is a site that connects like minds and delivers actionable insights for next-level growth.

U.S. Chamber of Commerce 1615 H Street, NW Washington, DC 20062

Social links

Looking for local chamber, stay in touch.

Your Ultimate Guide to Effective Sales Forecasting Methods

December 13, 2024

With 2025 just around the corner, it's time to discuss our targets and projections for another ‘new’ year ahead. Among all the planning B2B organizations should be making, sales forecasting is the critical one—your future depends on it.

Creating an accurate forecast can be challenging. After all, it’s a skill that demands an artistic touch to visualize future trends, a scientific approach to analyze data accurately, and mathematical prowess to quantify expectations. Adding to this challenge is the overwhelming ‘array of choices’, which can slow down the process and make it feel daunting.

Let’s help you with the most effective forecasting methods so that you can avoid information overload and focus on achieving your revenue targets.

In this blog, we have curated a list of the 11 best forecasting methods in sales to help you forecast with more sophistication and engagement.

Everything About Sales Forecasting

Sales forecasting involves estimating future sales revenue based on historical data, market conditions, and other influencing factors.

In case your organization is looking to anticipate how much revenue it can expect to generate and when that revenue will come in , sales forecasting can help them unlock the answers.

Essentially, it aids in:

- Anticipating revenue and setting achievable goals.

- Aligning resources effectively.

- Planning budgets, managing inventory, and hiring strategically.

- Revealing trends and potential challenges.

- Guiding investment decisions.

- Maintaining cash flow and preparing for growth.

On the other hand, inaccurate and ineffective forecasting can instigate several challenges, such as poor resource allocation, financial instability, operational inefficiencies, inventory management issues, strategic decision-making flaws, and many more.

(While on the subject, we have created an in-depth post on the best sales forecasting tools that offer superior accuracy, which might be helpful for you. For now, let’s focus on the techniques.)

Before diving into the best sales forecasting methods, let’s address the elephant in the room for a better understanding– demand forecasting vs sales forecasting .

Although both help businesses make informed decisions, demand forecasting and sales forecasting are different strategies. The crucial difference is that demand forecasting is market-focused, assessing overall consumer demand, while sales forecasting is company-focused, estimating what a particular business will achieve in sales.

11 Effective Forecasting Methods In Sales

Just like there are multiple ways to close a deal, there are different methods of forecasting sales. Primarily, there are two methods: Qualitative and Quantitative.

Of the below-enlisted methods, many take a bottom-up approach (projecting the expected number of seats or licenses you plan to sell and multiplying that by the average cost per unit).

On the other hand, some methods use a top-down approach (focusing on the overall industry picture—looking at your total addressable market (TAM) and then estimating your potential share of that market).

Qualitative Sales Forecasting Methods

Qualitative forecasting relies on judgment and opinion rather than numerical data, which is useful in cases where historical data is insufficient, such as for new products or industries with rapidly changing trends.

These forecasting methods are applicable when:

- Data is scarce or limited.

- A product is newly introduced to the market.

- Developing a solution may involve several innovations or iterations.

- R&D demands are hard to estimate.

- Market acceptance rates are uncertain.

Qualitative methods often rely on human judgment and rating systems to convert qualitative information into quantitative estimates.

Below are some commonly used qualitative sales forecasting methods:

1. Intuitive Forecasting Method

As the name implies, intuitive forecasting relies on the informed opinions of sales reps about the deals in their pipelines. This approach is built on the idea that sales reps, due to their close interactions with prospects, have the clearest insights into the likelihood of conversion.

Intuitive forecasting can easily integrate into your workflow if your sales teams conduct regular check-ins and collaborative pipeline reviews. However, it requires a thorough understanding of each prospect and an honest assessment of opportunities—making it potentially exhausting and sometimes susceptible to bias or subjective judgment.

2. Survey Method

The survey method involves gathering data directly from potential customers or target demographics through surveys or interviews. This approach is particularly effective for gauging interest in new products, understanding customer preferences, or exploring a new market.

For example, a company launching a new product can survey target customers about their interests and preferences, helping to anticipate demand before investing heavily in production.

Surveys can be conducted via email, phone, online questionnaires, or in person. The data collected provides valuable qualitative insights that, while subjective, help businesses make more informed decisions about product offerings and market expansion.

3. Test-Market Method

With the test-market method, companies introduce a product to a limited market area to evaluate its performance before a full-scale launch. This approach is popular for innovative or unique products that may need consumer validation before mass production.

Test-market analysis offers more than just revenue projections—it gives you a deeper understanding of customer needs and preferences. You can combine this approach with customer feedback or surveys to gain valuable insights for refining your product.

4. Delphi Technique (Panel of Experts)

The Delphi technique solicits opinions from a panel of experts on a specific product, service, or market trend. Experts contribute their knowledge of emerging industry trends, customer preferences, and competitive pressures. This method is particularly useful when launching a new product in a competitive market or where little quantitative data exists.

The Delphi technique is highly structured: experts provide their opinions in rounds, each time refining their responses based on the feedback received. Over time, this iterative process leads to a consensus forecast, supported by seasoned expertise.

5. Executive Opinion

In the executive opinion method, senior executives use their experience and insights to predict future sales. Executives often have a macro perspective on the industry and company strategy, allowing them to make informed judgments about future trends.

This approach can be effective for high-level planning, particularly in industries where market dynamics are influenced by regulatory, political, or economic factors. Although subjective, executive opinion can also bring a highly valuable organizational perspective during times when quantitative data is scarce or unreliable.

Quantitative Sales Forecasting Methods

Quantitative forecasting methods rely on statistical and mathematical models, using historical data to identify patterns and trends. These techniques are highly accurate when there is ample historical data, making them suitable for industries where products and demand patterns are stable over time.

Below are some commonly used quantitative sales forecasting methods:

6. Opportunity Stage Forecasting

Opportunity stage forecasting allows you to predict the likelihood of a deal closing based on where the prospect is in the sales pipeline. It is easy to implement and offers a better understanding of the sales process by giving essential information about how likely they are to make a sale at different steps along the way. This helps them make smart choices to improve their sales.

For example: Imagine a company has three active sales opportunities in different pipeline stages:

Opportunity 1 : In the Qualification stage with a potential value of $1,000.

Opportunity 2 : In the Proposal stage with a potential value of $2,000.

Opportunity 3 : In the Negotiation stage with a potential value of $1,500.

And the probabilities of closing each stage are Qualification (30%), Proposal (50%), and Negotiation (70%).

Here’s how the forecast can be calculated:

- Opportunity 1: $1,000 x 30% = $300

- Opportunity 2: $2,000 x 50% = $1,000

- Opportunity 3: $1,500 x 70% = $1,050

Total forecasted revenue: $300 + $1,000 + $1,050 = $2,350

7. simple moving average (sma).

The simple moving average method calculates the average sales over a specific period (e.g., three months or a year) to predict future demand. Each time period is treated equally, providing a straightforward way to estimate average demand without emphasizing any particular season.

For example, a business may calculate the SMA for the past twelve months to forecast sales for the next month. SMA is ideal for stable industries where demand remains relatively constant and is less affected by seasonal fluctuations.

8. Length of Sales Cycle Method

This forecasting method is straightforward; it helps you predict exactly when a deal is likely to close based on your sales cycle’s length. You don’t need to rely on the rep’s feedback or gut feeling to predict revenue outcomes. You must carefully track how and when leads enter your sales pipelines to get the most accurate forecasts.

To calculate, simply tally up the total number of days it took to close all recent deals. Then, divide that by the number of deals you closed.

9. Weighted Moving Average (WMA)

The weighted moving average method assigns different weights to time periods, giving more importance to certain periods based on expected seasonal demand. This method is beneficial for industries with clear seasonal patterns, like retail or food and beverage, where demand may peak during certain months.

For example, a company may assign higher weights to months leading up to the holiday season, ensuring that inventory levels match the expected surge in sales. This method helps avoid overproduction or underproduction during key selling periods.

10. Exponential Smoothing

Exponential smoothing is a sophisticated approach that applies decreasing weights to past data as it moves further from the present.

This forecasting method adjusts the forecast based on recent observations, making it highly responsive to sudden changes in demand trends, and is effective in industries where demand patterns are prone to short-term fluctuations.

11. Linear Regression

Linear regression is commonly used when companies want to analyze how specific factors influence sales, like marketing spend or product pricing.

For example, a company may use linear regression to determine if there is a direct relationship between advertising expenses and sales growth. Linear regression models can provide actionable insights for budgeting and strategic planning by quantifying how much specific factors impact demand.

To conduct this analysis , sales teams must have a clear understanding of the internal and external factors affecting their sales and determine the reasons for forecasting, factors affecting sales (dependent variable), areas that are being affected (independent variable), and review time period.

Once you have collected the information, collect the data for both dependent and independent variables, choose a regression model and run it, and look for correlation between variables.

What’s the Best Method For You?

Choosing the best forecasting technique involves balancing complexity, accuracy, and the business environment. Here’s a guide to help you select the suitable method:

- Data Characteristics and Availability

Analyze data trends and consistency. Quantitative techniques, such as regression or time series analysis, excel when historical data is extensive. In contrast, qualitative methods, like expert panels, work well for new products lacking past data.

- Forecasting Time Horizon

The timeframe of your forecast influences the choice of method. Short-term needs, like inventory management, benefit from simpler approaches like moving averages, while long-term planning may require complex models to capture broader trends and market shifts.

- Resource Constraints and Usability

Forecasting should match your team’s capacity. Smaller teams may find simpler models or software solutions more manageable, while sophisticated techniques may demand more resources and advanced analytical skills.

- Market Volatility

Stable industries can often rely on quantitative methods like exponential smoothing, which incorporates recent trends. However, qualitative approaches in volatile industries can offer flexibility to adjust to rapid changes.

- Decision-Making Goals

Align your method with business priorities. For seasonal patterns, weighted moving averages capture fluctuations effectively, while for highly variable demand, a combination of methods might provide a more comprehensive view.

In a Nutshell

The need today is not for better forecasting methods but for better application of the techniques at hand.

Understanding the basic features and limitations of the above-listed sales forecasting methods can help you properly frame the forecasting problem and use them more effectively. Over time, you can experiment with different approaches to determine which method works best.

Intrinsically, the lack of a clear, organized, and transparent process can hinder accurate forecasting, letting crucial data slip through the cracks. It is, hence, crucial that you automate as much data as possible to let your team focus on important tasks, ensuring leaders have a clear view of the sales pipeline for confident forecasting.

Forecast with confidence by configuring Sybill with your CRM for instant answers and real-time updates on deal progress, risks, and opportunities after every meeting. Click here to catch Sybill in action.

Get started with Sybill

Accelerate your sales with your personal assistant

Table of Contents

Related blogs.

The ‘Discovery Call Massacre’: Rip and Replace Your Old Tactics

Engage, Close, and Onboard Faster with Sandler Pain Funnel

Templateral

Sales Business Plan Template (Word)

A sales business plan is essential for any business looking to achieve its sales goals and objectives. It serves as a roadmap outlining the strategies and tactics to drive sales and revenue growth. A well-designed sales business plan provides a clear direction for the sales team, helps identify potential opportunities and challenges, and guides decision-making processes.

This article will discuss the importance of a sales business plan and provide tips on creating an effective one.

What is a Sales Business Plan?

A sales business plan is a document that outlines the sales goals, strategies, and tactics of a business. It provides a comprehensive overview of the sales process, including target market analysis , sales objectives, marketing strategies, sales forecasts, and action plans.

A sales business plan can be shared with the sales team, management, and stakeholders to ensure everyone is aligned and working towards the same goals.

Why is a Sales Business Plan Important?

A sales business plan is crucial for several reasons:

- Guides Decision-Making: A well-defined sales business plan helps in making informed decisions by providing a clear roadmap. It ensures that all decisions align with the overall sales goals and objectives.

- Identifies Opportunities and Challenges: A sales business plan helps identify potential opportunities and challenges in the market. It allows businesses to proactively address challenges and take advantage of opportunities to maximize sales.

- Aligns Sales Team: A sales business plan serves as a communication tool that aligns the sales team with the company’s sales goals. It provides clarity on what needs to be achieved and how it can be accomplished.

- Measures Performance: By setting clear sales objectives and targets, a sales business plan allows businesses to measure their performance accurately. It helps identify areas of improvement and track progress toward sales goals.

How to Create a Sales Business Plan

Creating a sales business plan involves several key steps:

1. Define Your Sales Goals and Objectives

The first step in creating a sales business plan is to define your sales goals and objectives. These should be specific, measurable, achievable, relevant, and time-bound (SMART). Determine the revenue targets, market share goals, and other key performance indicators you want to achieve.

2. Conduct a Target Market Analysis

Understanding your target market is crucial for developing effective sales strategies. Conduct market research to identify your ideal customers, their needs, preferences, and buying behaviors. This analysis will help you tailor your sales approach and messaging to resonate with your target audience.

3. Develop Sales Strategies and Tactics

Based on your target market analysis, develop sales strategies and tactics. These may include pricing strategies, promotional activities, lead-generation techniques, and customer relationship management strategies. Determine the most effective channels to reach your target audience and outline the steps required to convert leads into customers.

4. Create a Sales Forecast

A sales forecast estimates the expected sales revenue over a specific period. It provides insights into future sales performance and helps in resource planning. Consider historical sales data, market trends, and the impact of marketing initiatives while creating your sales forecast.

5. Define Action Plans

Break down your sales strategies and tactics into actionable steps. Define specific action plans for each stage of the sales process and assign responsibilities to team members. Set clear timelines and milestones to track progress and ensure accountability.

6. Monitor and Evaluate Performance

Regularly monitor and evaluate your sales performance against the defined goals and objectives. Use key performance indicators (KPIs) such as sales revenue, conversion rate, customer acquisition cost, and customer lifetime value to assess your progress. Adjust your strategies and tactics as needed to stay on track.

7. Review and Update the Sales Business Plan

A sales business plan is not a static document. It should be reviewed and updated periodically to reflect changes in the market, business goals, and competitive landscape. Regularly assess the effectiveness of your strategies and make necessary adjustments to ensure continued growth.

Example of a Sales Business Plan

Here are some examples of how a sales business plan could be structured:

Tips for Successful Sales Business Planning

Here are some additional tips to create a successful sales business plan:

- Involve the Sales Team: Include the sales team in the planning process to gain insights and buy-in. Their input and expertise can improve the effectiveness of the sales business plan.

- Set Realistic Goals: Ensure that the sales goals and objectives are realistic and achievable. Setting unrealistic targets can demotivate the sales team and hinder performance.

- Monitor Competitors: Keep a close eye on the activities and strategies of your competitors. Understand their strengths and weaknesses to develop a competitive advantage.

- Regularly Communicate and Train: Regularly communicate the sales business plan to the sales team and provide training on new strategies and tactics. This ensures everyone is aligned and equipped to achieve the sales goals.

- Measure and Adjust: Continuously measure sales performance and adjust strategies as needed. Regularly review the sales business plan to ensure it remains relevant and effective.

- Celebrate Success: Recognize and celebrate sales achievements to motivate the team. This fosters a positive sales culture and encourages continued success.

A sales business plan is an indispensable tool for any business aiming to achieve its sales goals and objectives. By following the steps outlined in this article and incorporating the tips provided, businesses can create an effective sales business plan that guides their sales efforts and drives success.

Free Sales Business Plan Template!

Achieve your business goals with our sales business plan template! This comprehensive tool helps you outline strategies, set targets, and track progress to boost sales and drive growth. Perfect for startups or established businesses, it provides a clear roadmap for success.

Use our template to create a winning sales plan today!

Sales Business Plan Template – Download

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

This website uses cookies to enhance the user experience.

Like this content? Sign up to receive more!

Subscribe for tips and guidance to help you grow a better, smarter business.

We care about your privacy. See our Privacy Policy .

🎧 Real entrepreneurs. Real stories.

Subscribe to The Hurdle podcast

You can do this! Tour LivePlan to see how simple business planning can be.

Have an expert write your plan, build your forecast, and so much more.

Integrations

For Small Businesses

For Advisors & Mentors

How to Do a Sales Forecast for Your Business the Right Way

15 min. read

Updated November 22, 2024

New (and established) entrepreneurs frequently ask me for advice about one thing—sales forecasting.

These entrepreneurs tend to be optimistic about the future but are worried about creating unrealistic sales targets. When it comes to the details, most aren’t sure how to create accurate sales projections and struggle to predict how much money they will really make.

It’s an intimidating task, looking into the future. The good news is, none of us are fortune tellers and no one knows more about your business than you do.

If you do happen to be able to see into the future, please just skip the whole startup thing and go play the stock market. It’ll be much easier and make you richer!

My advice? Just take a deep breath and relax. You’re as well equipped as everyone else to put together a credible, reasonably accurate forecast.

What you will learn

- 1. Why "bottom-up" forecasting is better than "top-down" and what these forecasting methods are.

- 2. Why you shouldn't create a forecast for everything that you're selling.

- 3. How to check your assumptions before forecasting to improve your accuracy.

What is sales forecasting?

Sales forecasting is the process of estimating future sales so you can make smart business decisions.

A sales forecast is typically based on any combination of:

- • Historical sales data

- • Industry benchmarks

- • Economic trends

Sales forecasting is a method designed to help you better manage your workforce, cash flow, spending, and any other resources that may affect revenue and sales.

It’s typically easier for established businesses to create more accurate sales forecasts based on previous sales data. Newer businesses, on the other hand, will have to rely on market research, competitive benchmarks, and other forms of interest to establish a baseline for sales numbers.

For more details, check out our guide on creating a financial forecast without historical data .

Why is sales forecasting important?

Sets the stage for your full financial plan.

Your sales forecast is the foundation of the financial story that you are creating for your business.

Once you have a complete sales forecast, you can easily create your profit and loss statement , cash flow statement , and balance sheet .

Informs business goals

Beyond setting the stage for a complete financial forecast, your sales forecast helps you set realistic goals for your company. By predicting future sales, you can answer questions like:

- • What do you hope to achieve in the next month? Year? 5-years?

- • How many customers do you hope to have next month and next year?

- • How much will each customer hopefully spend with your company?

Answers investor questions

Having a solid sales forecast also provides a picture of your performance for potential investors.

Like you, they want to see established goals and a firm trajectory for your business. The more detailed, organized, and up-to-date your sales forecast is, the better you can pitch and explain the position of your business to third parties and even employees.

Better manage expenses

Whether you start your financial forecast with sales or expenses you need to figure out the other half of the equation. Your sales forecast will guide how you approach budgeting and help you understand the minimum amount of sales needed to cover expenses.

Assuming you want to run a profitable business, you’ll use your sales forecast to figure out how much you should spend on things like:

- • Marketing to acquire new customers

- • Operations and administration

- • Production costs

- • Personnel

Minimize risk when pursuing growth

Now, you don’t always need to be profitable, especially if you are trying to grow aggressively. In this situation, you may want to have an aspirational sales forecast—where you make strong sales projections and plan to figure out how much more to invest into your business.

What you don’t want to do is immediately start spending like this optimistic growth is guaranteed. Instead, use your sales forecast to figure out how much:

- • More you want to sell

- • More you will need to spend

- • Cash you need to maintain

If you don’t have a sales forecast and blindly attempt to grow—you’ll struggle to hit targets, potentially overspend, and risk running out of cash altogether.

Which sales forecasting model is best?

Many startups make this mistake—and it’s a big one.

They forecast “from the top down.”

This means they figure out the total size of the market (TAM, or total addressable market) and then decide to capture a small percentage of that total market.

The problem? This kind of guessing is not based in reality. Sure, it looks credible on the surface, but you have to dig deeper.

- • What’s driving those sales?

- • How are people finding out about this new smartphone company?

- • Of the people that find out about the new company, how many will buy?

So, instead of forecasting “from the top-down,” do a “bottom-up” forecast.

- 1. Start with how many potential customers you could make contact with through advertising, sales calls, or other marketing methods. This is your SOM (your “share of the market”) , the number of people you will realistically reach—particularly in the first few years of your business.

- 2. Of the people you can reach, how many do you think you’ll be able to bring in the door or get onto your website?

- 3. And finally, of the people that come in the door, get on the phone, or visit your site, how many will buy?

Here’s an example:

- • 10,000 people see my company’s ad online

- • 1,000 people click on the ad to my website

- • 100 people end up making a purchase

These are all nice round numbers, but it should give you an idea of how bottom-up forecasting works.